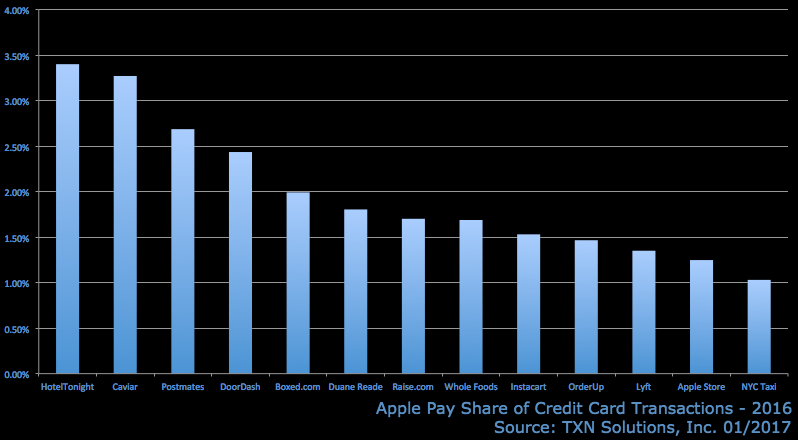

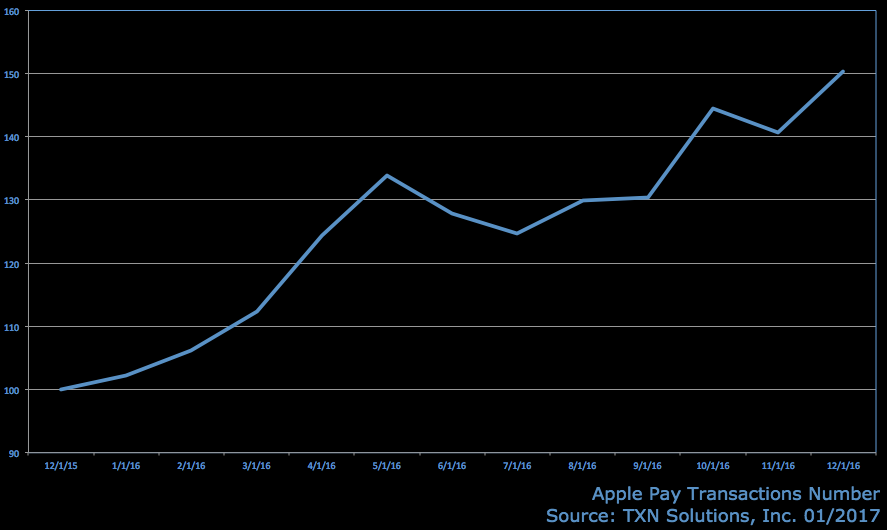

I recently called Apple Pay and other mobile wallet services as the stealth growth story of 2017 and 2018. As more and more merchants adopt the technology and more importantly "train" the customer and employee on mobile payments, we will see a steady increase in brick & mortar. On the ecommerce side, I am nothing but bullish as mobile sites join the apps already accepting mobile wallets.

TXN recently released a study providing a bit of insight on that growth. A few takeaways:

1. The study is based on 3 million payment cards of their consumer panel. Keep the small size in mind when reviewing.

2. Growth in transactions year over year is 50%.

3. Mobile only service providers like HotelTonight and Caviar saw the highest percentage of transactions using Apple Pay at just over 3%.

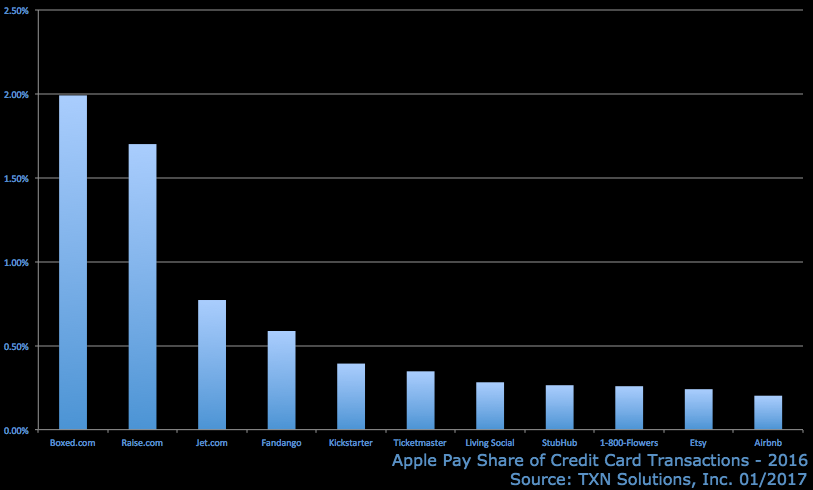

4. Retailer websites such as Boxed and Raise were just under 2% in total transactions that were paid with Apple Pay.

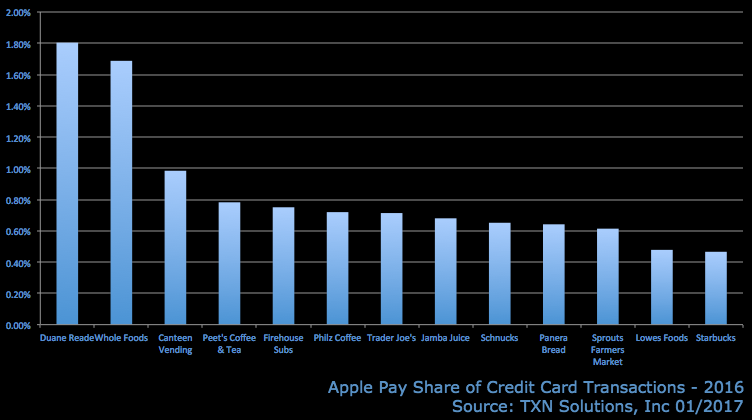

5. Brick & mortar players such as Duane Reade and Whole Foods were just under 2% of total transactions using Apple Pay.

Bottom line: While none of these statistics are mind blowing, I believe we will see a steady increase over the course of the next few years. Nothing but optimism for this space.