Not only did traditional pay TV see it's first negative net subscriber quarter in Q1, but also the most severe drop in Q2 seen in several years. The trend does not seem to be slowing.

Netflix UK & Original Programming

The two biggest online TV services in the UK, Netflix and Amazon’s Prime Instant Video, have invested heavily in original programming in a bid to attract more subscribers. Amazon recently struck a £160m deal to create a new show with former Top Gear stars Jeremy Clarkson, Richard Hammond and James May.

Just 31% of people told Ofcom in April they used an online TV service to watch original programming, compared to 75% who said they used the service to watch films and almost half who said they watched US shows.

The Quiet Giant: Vine

Vine serves more than 100 million people across the web every month, according to the company, delivering more than 1.5 billion “loops”—its term for video views—per day. It is a top-100 free iPhone app in 13 countries, according to App Annie, a service that tracks app stores, and is currently ahead of Tinder and Shazam in the US rankings.

Meanwhile, comScore says Vine reached 34.5 million unique visitors in the US in June across desktop and mobile—roughly the same as Snapchat, which has grown rapidly over the past year and is valued by investors at $16 billion.

UK Etail Sales to Overtake Retail Internet Sales

Sales made by internet companies without physical stores, such as Amazon and Asos, will surpass online sales of store-based UK retailers for the first time this year

So-called "etailers" are expected to generate £21.8bn-worth of sales in 2015, an increase of 18pc from last year, while traditional stores should grow their online sales by 11pc to £21.5bn, according to a report from market research firm Mintel.

The Facebook Virus

There was no shortage of jaw dropping statistics highlighting how Facebook continues to spread like a virus globally. Within the US specifically, this statement from Sheryl Sandberg required a double take:

"We continue to get more than one out of every five minutes on smartphones in the U.S."

Tech Infused Retail Newsletter #87

Google showed off quite a few new tools embedded within the various ad types they run for retailers within search apps. The buy buttons created the most excitement but it was good to see tools allowing customers the ability to search inventory at specific stores or even be notified of price doors on particular items. Google is happy with driving, influencing or processing the purchase. Link

In other news, Google announces the launch of Eddystone for beacons. Pretty compelling announcement as the platform is open, cross-platform and will allow beacons to drive engagement through browsers and not just downloaded apps. This might be a case of slow and steady wins the race when comparing to iBeacon from Apple. Link

Facebook gets serious about empowering eCommerce within store pages. Link

Facebook using Messenger to test virtual assistant named Moneypenny. Link

What would food delivery be without Groupon? Link

Why Alibaba stumbled in the US with 11 Main offering. Link

Venmo transacted $1.6b in payments this quarter, a rise of 240%+. Small when compared to eBay's $66b, but service has definitely found a market niche. Link

Messaging is changing how we use social media. Link

Oculus buys hand-tracking company. Might this bring augmented capabilities eventually? Link

More of the same...Google Play downloads exceed iOS and iOS revenue exceeds Google Play. One point of interest, China iOS downloads now exceed the US...inevitable but now realized. Link

Pew provided a thorough update to social media access for news. Basic findings were Twitter and Facebook are becoming more of a critical role for news consumption and unsurprisingly continue to be more popular for the younger generations. I would expect Facebook to see improvements in importance for news as they shift focus to surfacing content from mainstream media outlets. A few of the worthwhile charts (Link):

Gmail maintains dominance and becoming more so according to Mailchimp stats (Link):

US Smartphone Statistics: More Apple, More Facebook

A few stats I found interesting in the latest comScore US Smartphone Market Share Report:

- Approximately 190 million US smartphone users which accounts for a penetration rate of ~77% of the mobile market. Significant growth still ahead for smartphones.

- Apple was a winner in both smartphone handset market share and operating system market share growth versus February 2015.

- Facebook has a reach of 70% on US smartphone users. Incredible to know that 70% of all smartphone users in the US have the Facebook app on their smartphone.

Tech Infused Retail Newsletter #86

In a further push to satisfy activist shareholders and focus on the Marketplaces business, eBay looks to divest their previously acquired GSI Commerce business. Link

American Express finally announces their online payments play. Because Amex controls the account management vs. Visa and Mastercard who issues cards through banks, the process seems a lot simpler for consumers. Auto populated shipping address and payment information using your everyday American Express login credentials. The land grab for the checkout page continues now that every major issuer has their own button. Link

Most marketers believe Facebook's new pricing model based on website clicks will lead to increased spending. I generally agree as the targeting abilities of Facebook far outweigh those of Google and this eliminates the question that baffles most marketers: What is the value of a like? Link

Facebook testing picture in picture / second screening. Link

Twitter is now allowing for birthday submission to drive improved targeting. Link

Pinterest has become a social login for other sites and apps. Link

KFC in China using Alipay. Link

Google's Waze testing carpooling in Israel. Very interesting as we know Google is an investor in Uber. Link

Bitcoin transactions per day are seeing new highs with Greek liquidity crisis and Chinese market correction as the price briefly broached $300 pre-Greece deal.

With the latest updates to retail sales, the department store sales versus overall retail sales show why the department store space continues to "shift the pie":

Commerce Point of Entry: Amazon

A good friend of mine, Chuck Martin recently highlighted the findings of a Mizuho survey of 1,000 smartphone users on where consumers turn to when searching for information. Unsurprisingly, Google is the first choice:

- 34% -- Open Google search app

- 27% -- Open Safari browser and type inquiry

- 19% -- Open Chrome browser and type inquiry

- 9% -- Go to specific apps like Maps, Yelp

- 7% -- Use voice search (Siri, Google Now)

However, when consumers are shopping on smartphones, the picture is quite different:

- 45% -- Amazon

- 16% -- Google

- 6% -- eBay

- 2% -- Walmart

- 1% -- Target

- 1% -- RetailMeNot

With Amazon owning 45% of search volume, including Amazon in any brand or retailer's traffic acquisition strategy is a must. Amazon and subsidiaries have evolved into the largest point of entry for smartphone commerce.

Can GameStop Survive?

I am often asked if GameStop can buck the trend of physical media transitioning to digital content. Will GameStop go the way of Border's, Barnes & Noble, etc?

Whilst digital downloads on consoles are still quite low, the ability to download full size console content is actually quite new. Given the size of games, the limited access to high bandwidth internet connections and poor marketplace interfaces, downloading console games has never been an enjoyable experience. That is all changing...high bandwidth connections are ubiquitous, games can be booted using a partial download and the publishers are pushing direct to consumer sales much harder. Direct to consumer downloads have better margins for publishers by avoiding the middle man (the retailer) and allow for games to avoid the used market.

Given that GameStop makes the majority of its profit on used games and consoles, I believe they will inevitably see an impact as digital downloads become more prevalent. GameStop feels the sense of community with gamers will keep them relevant but we have seen how that played out for the Borders and Barnes & Nobles of the world. Book reading and sharing moved to locations such as Starbucks while sales moved to Amazon through the Kindle. GameStop realizes this and has been aggressively trying to broker deals with publishers to allow for used game reselling. Allowing for used game reselling would be a tremendous win for GameStop but margins would still be lower than current physical game sales. For these reasons, I believe we will soon see an inflection point in digital console game sales forcing GameStop to evaluate the number of store locations and focus on selling consoles versus actual games. Although the overall market is stronger than ever, I'd argue GameStop has some of its' toughest years ahead.

Razor Sales Move Online

The online market for razorblades barely existed a few years ago, yet Americans have taken to it quickly: Web sales of men's shaving gear in the U.S. have nearly doubled in the 12 months through May to $263 million, according to estimates from Slice Intelligence, a market research firm.

That is about 8% of the roughly $3 billion market and a big surprise to people who follow the market.

The pace continues to quicken. In the first five months of 2015, online sales amounted to $141 million, more than double that a year ago, according to Slice.

More than double last year...>15% of total sales are now coming from online. Although the deep pockets of venture capital funded startups like Dollar Shave Club and Harrys are funding this shift, the trend continues. Currently in the US, there is a 90/10 split on brick and mortar to online. However, more connected countries like Korea are already seeing 14-15%.

Side note, I'd love to know the percentage of Gillette's business that is now purchased online from various retailers.

Commerce & Apple Watch

Groupon is the best example of commerce conducted through Apple Watch thus far.

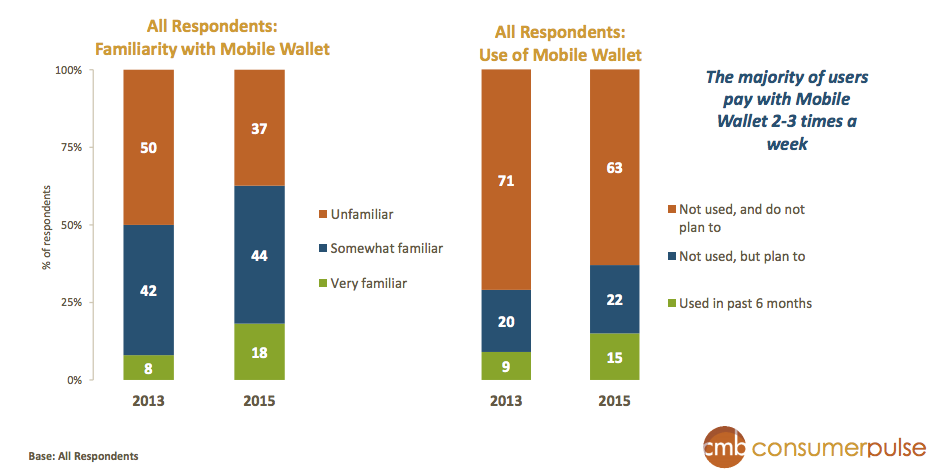

Familiarity and Use of Mobile Wallets Increasing

CMB recently released a survey of 1,500 consumers and their views on mobile wallets. Key takeaway: familiarity and use still small but increasing.

In-Store Positioning & Promotions via Lights

Heightened Expectations in Shipping

Amazon continues to set the benchmark for customer expectations. Same day shipping as part of Prime membership is now available in 500 cities/towns (14 markets). Stats from just a year ago show most customers are willing to wait for shipping if free, but now customers have come to expect expedited shipping for free. There is only one way to pay for that...through membership plans like Prime or building it into the product cost. There is no "free shipping."

The Importance of Speed: Facebook Instant

In Facebook's drive to house more content and provide a better browsing experience, they have launched Facebook Instant. The general idea is to virtually eliminate any load times for content as speed is arguably the number one requirement for success on mobile. The alternative is long load times via browser and high bounce rates/low engagement. Take a look at the difference in story load times compared below.

Whilst this is nothing new and others have deployed solutions within media already, I believe Facebook will be the catalyst to require faster load times from eCommerce sites. Retailers can no longer rely on the mobile browser and must provide a faster experience whether by native app, overlays in other apps or optimized mobile sites.

So this Facebook instant article loaded around seven seconds faster than a Twitter link pic.twitter.com/quSC7kGD5Y

— Matt Roper (@mattjroper) May 13, 2015Desktop vs. Tablet vs. Smartphone

Q1 2015 statistics from MarketLive show improving conversion, average order value and cart abandonment across the board for tablet and smartphone (see chart below). This will continue as mobile payment and single sign on improves.

Jet.com Mystery Shop

With all the headlines Jet.com is receiving and the recent raise of $140 million valuing the company at $600 million, I figured I had to try out the service.

In order to meet the free shipping threshold of $35.00, I decided to purchase a fairly routine purchase of 2 pairs of underwear. The list price was $21.00 per unit but I was able to save several dollars by paying with a debit card and forgoing the option to return the items. Total price was $18.81 per unit for a total of $37.62. Upon checkout, I was told the item would be delivered in 2-5 days from Jet.com Trusted Retail Partner. The order was on 5/2, shipped that same day and delivered on 5/7. Upon receiving the shipment, I found that the items were shipped by Nordstrom. The packing slip and packaging was labeled Nordstrom.

Jet.com Advantages

By acting as a referral platform for other ecommerce stores, Jet.com holds no inventory and eliminates most of the risk most retailers face. The transparent price savings through payment method choice and providing sales with a no return policy allows Jet.com to provide savings to both the customer and retailer. The model is clean and ultimately provides a compelling value to any online shopper that doesn't care about which retailer ships their order.

Retailer Implications

More eyes on products leads to more sales. Better sell throughs lead to more productive inventory. However, retailers are paying for these sales and would prefer the sale to come through their own site. Additionally, the retailer doesn't own the end customer and doesn't have the ability to market to that customer for future orders.

Model Sustainability

The model is sustainable as long as Jet.com drives traffic to their site and retailers are willing to place product on Jet.com. Drop shipping direct to customer is a trend that most brands are familiar with and I believe retailers will continue to fuel online sales using this method.

Bottom Line

Jet.com is onto something. They have replicated the Amazon and Alibaba marketplace model in much cleaner way. Jet.com will be successful earning affiliate fees through sales, eventual membership fees and minimizing inventory risk. If growth ever sputters, they will eventually need to take on inventory.

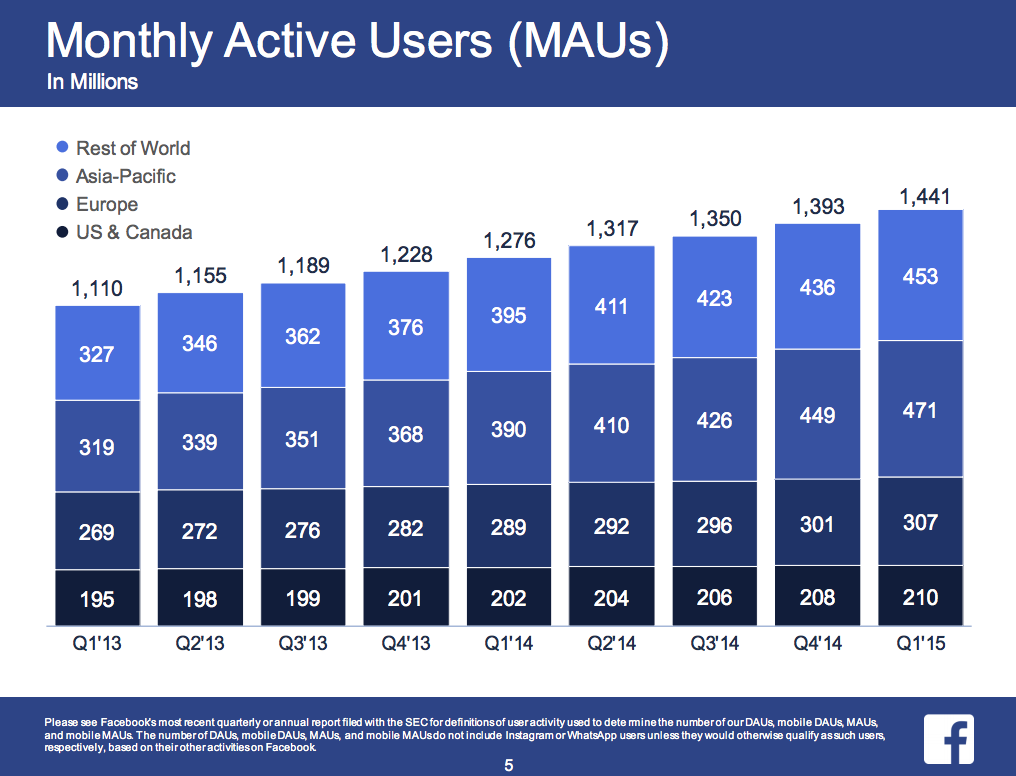

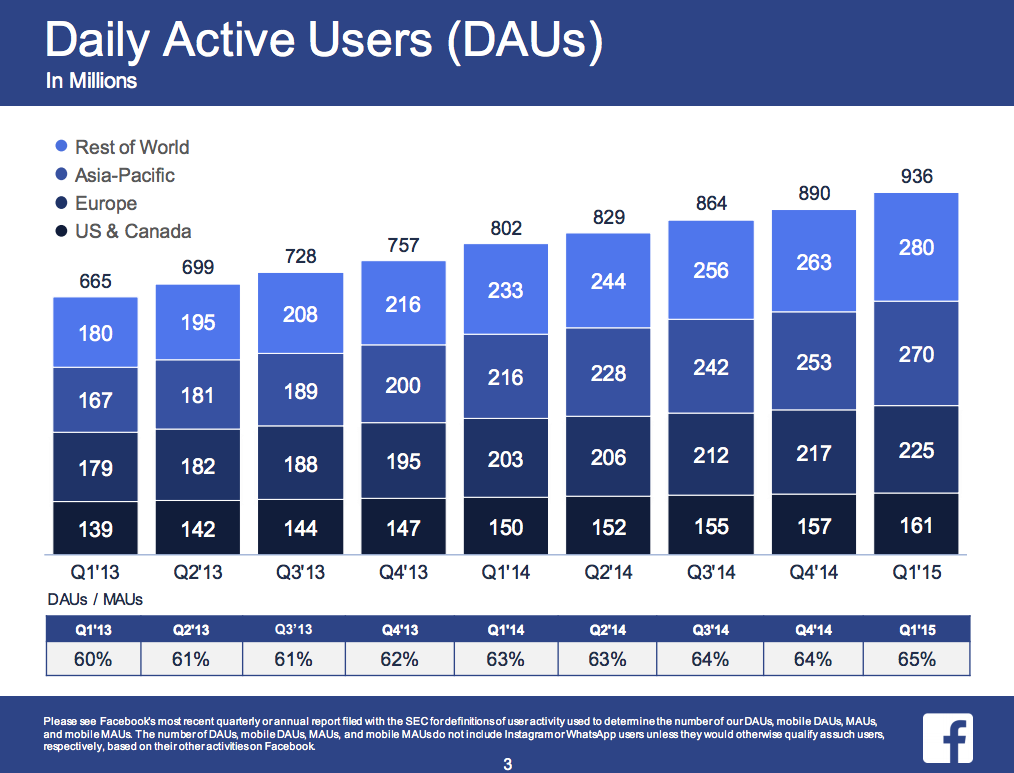

Facebook Numbers

Facebook has fallen out of favor with Wall Street but the numbers reported in the latest quarter are mind boggling. Monthly active users of 1.4 billion of which 65% or 936 million are daily active users. More importantly, the Average Revenue Per User (ARPU) was up year over year in all geographies a minimum of 20%. I am quite optimistic Facebook has just begun to monetize their user base. For context, Google ARPU was approximately 6x Facebook last quarter. A few of the slides showing the scale of the Facebook ecosystem shown below:

State of Bitcoin: Q1

Coindesk, the authority on bitcoin recently published the Q1 State of Bitcoin. Basic takeaways were as follows:

- Number of wallets are up 11% to last quarter and forecast for growth remains intact

- Merchants acceptance growth has slowed considerably

- Transaction volume continues to grow but bitcoin largely remains a store of value

- Price declines will lead to further consolidation within mining

- Led by Silicon Valley, historic investments continue

Bottom line: Consumer adoption remains strong, merchant adoption is slowing and exchange transactions need to strengthen.