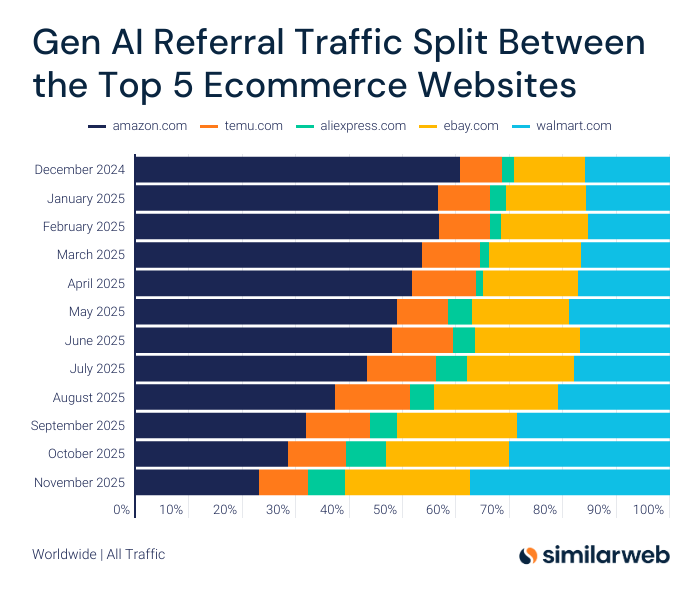

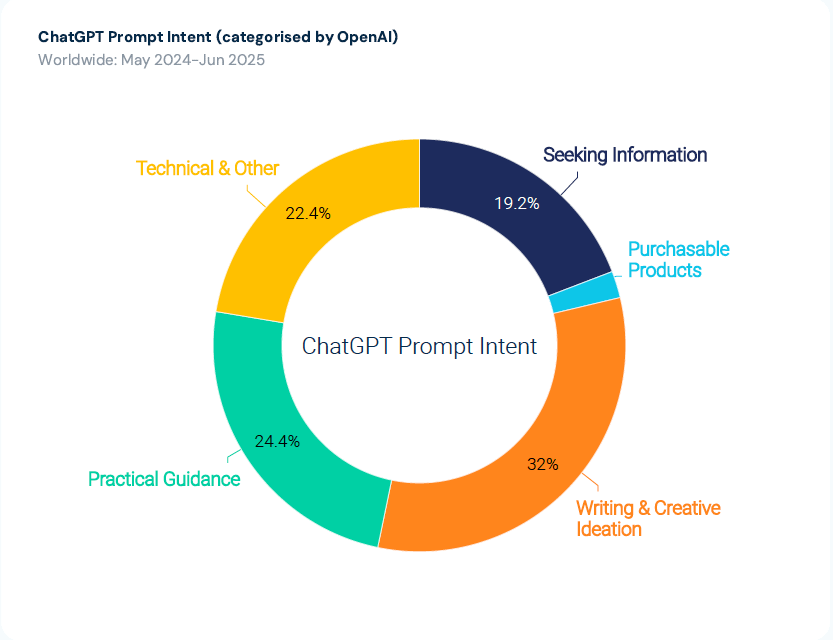

Gen AI referrals are still a small slice of the pie in absolute terms, but they are already punching far above their weight in impact.

How big is Gen AI vs other referrals?

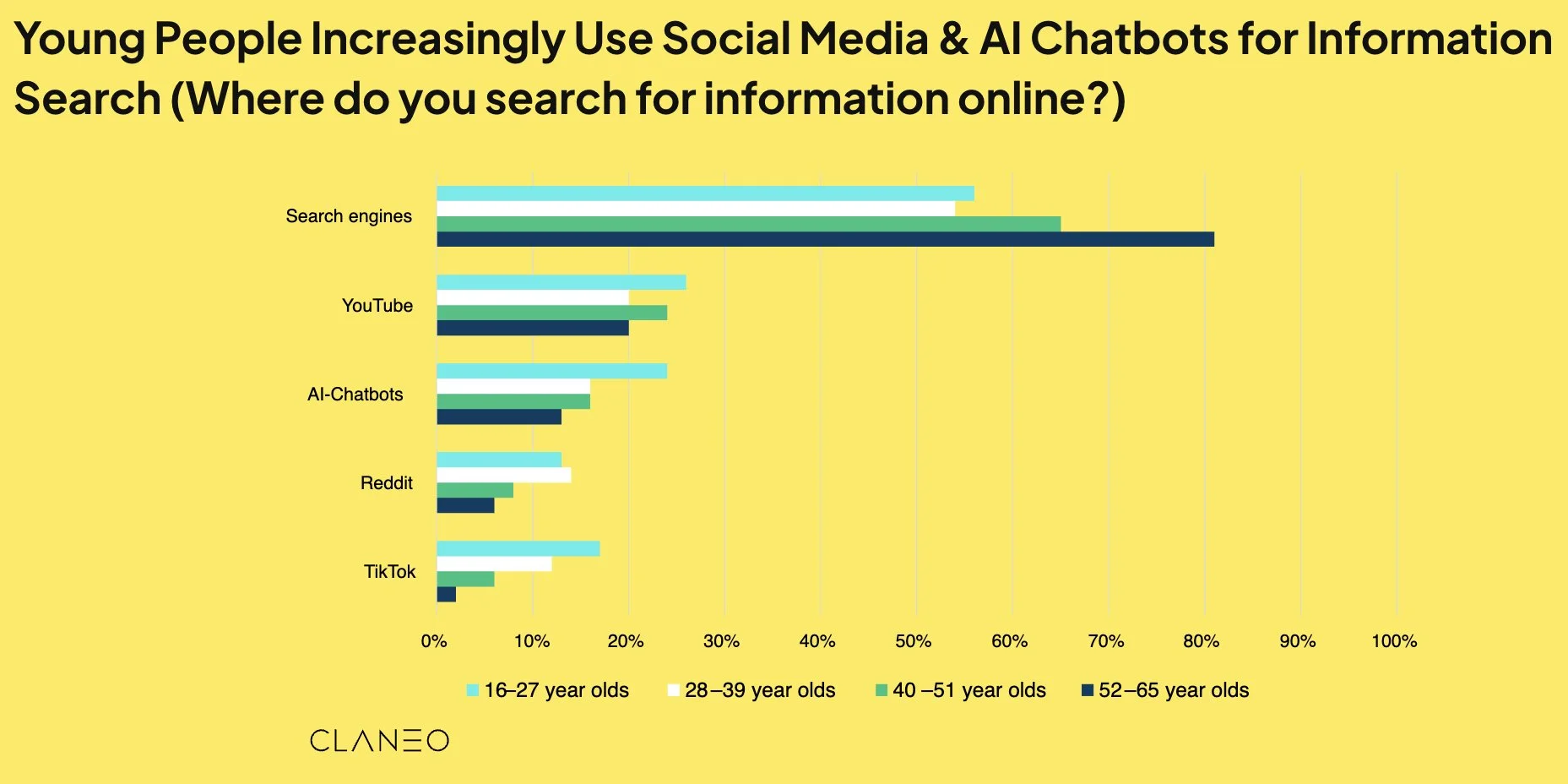

Across major industries, AI platforms currently drive only about 1% of overall web traffic, meaning 99% still comes from search, social, direct, email, and other traditional sources.

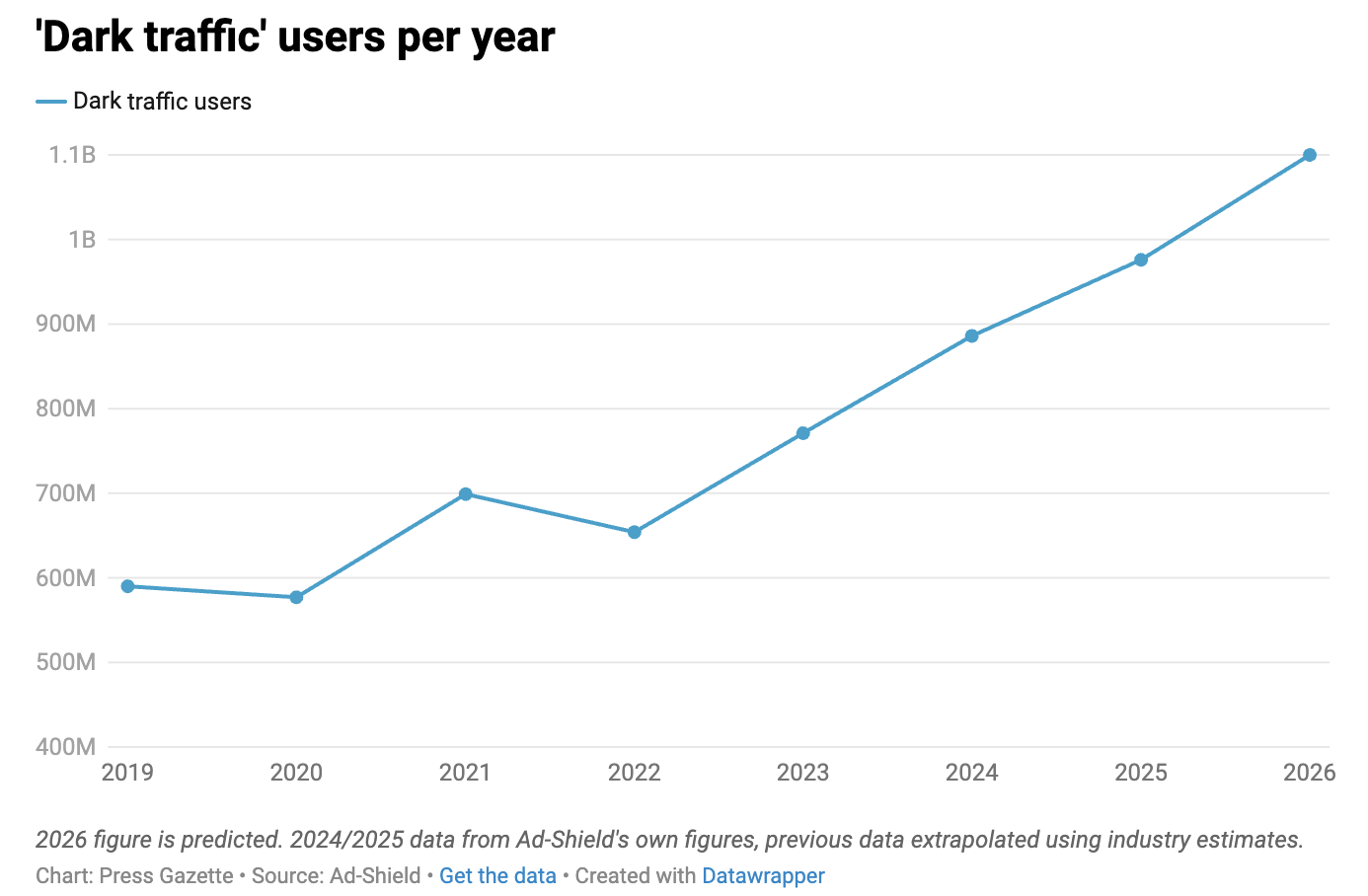

In June 2025, Similarweb estimated roughly 1.1–1.13 billion AI‑driven referral visits vs about 191 billion from Google Search alone, so Google is still sending ~170x more clicks than AI platforms.

Even at ~1% of traffic, AI referrals convert at materially higher rates, with Similarweb citing ~7% conversion to transactional sites, outpacing traditional search and most other referrers.

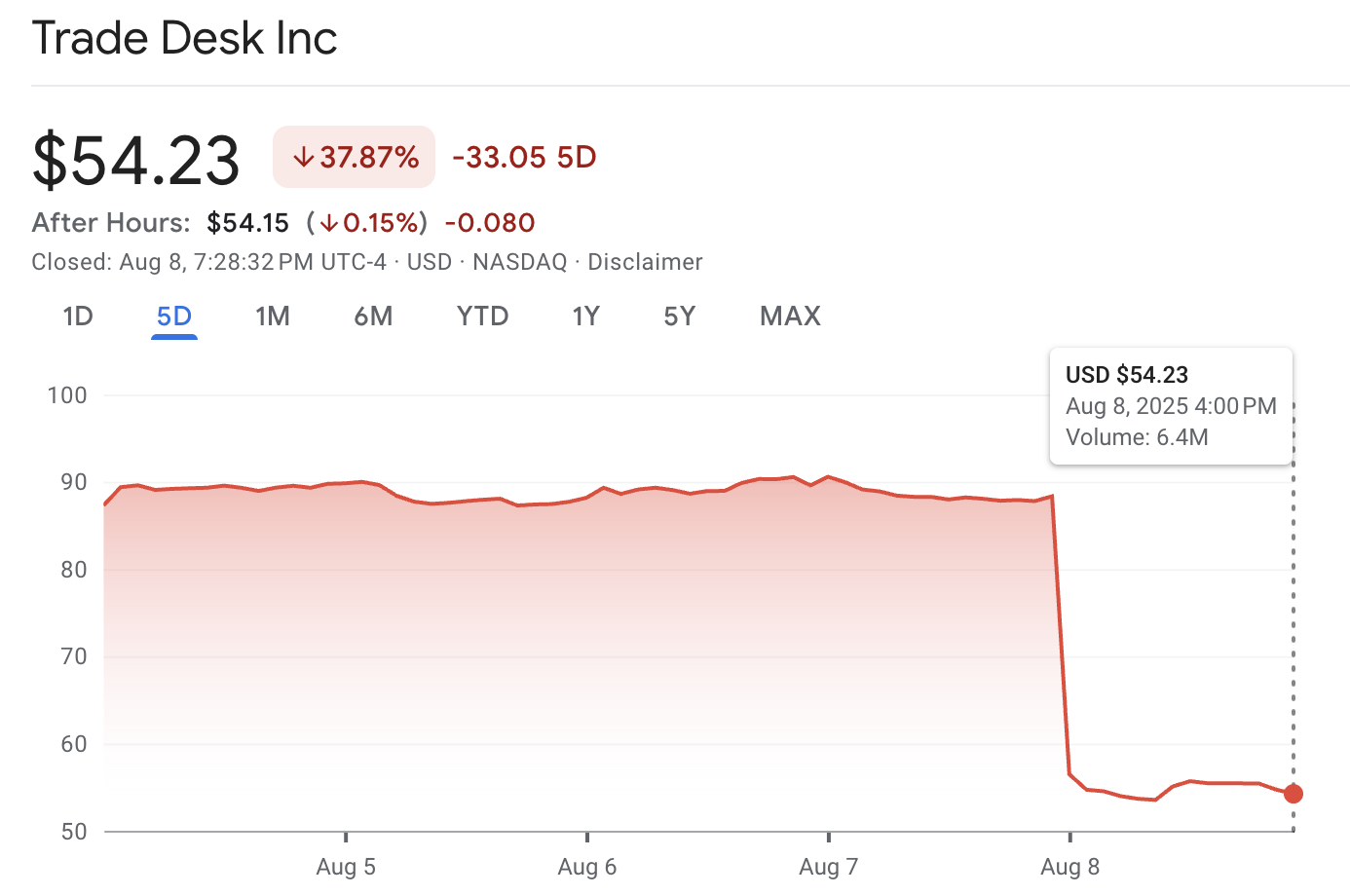

Who is winning and losing?

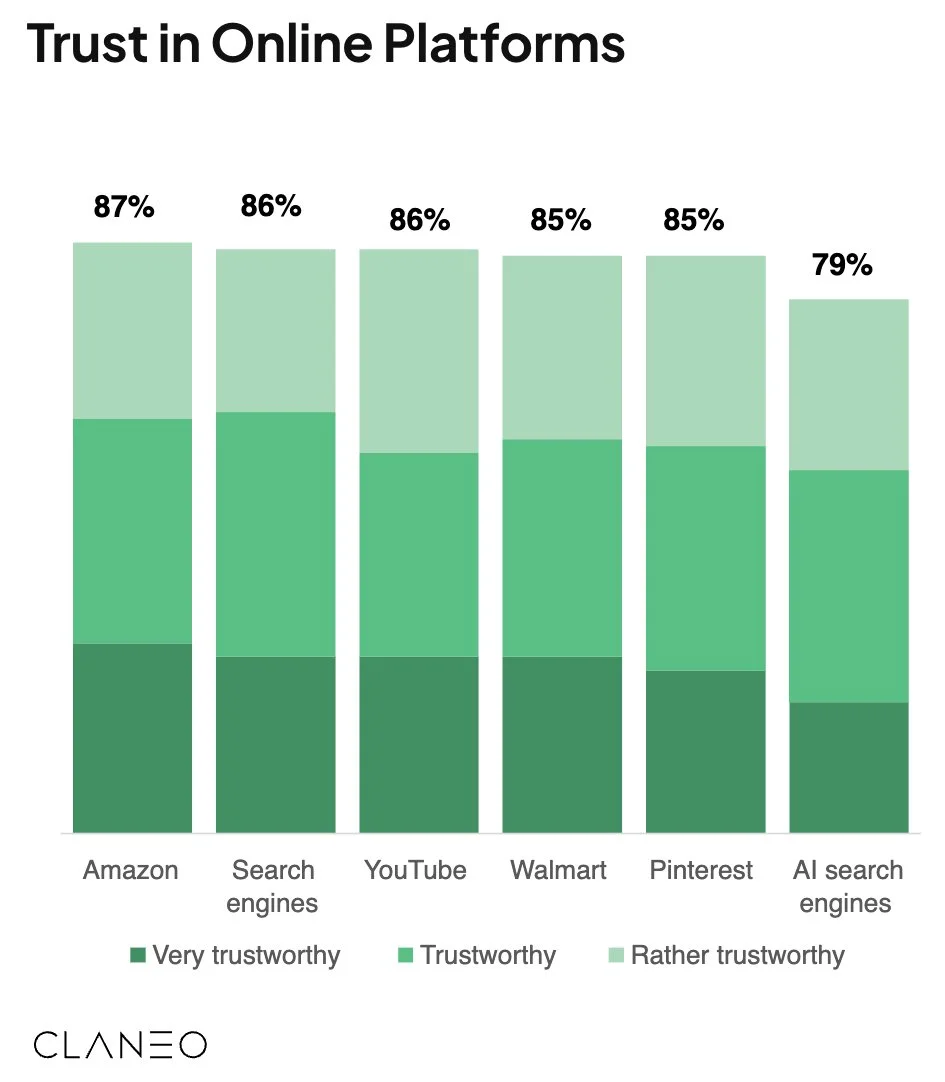

Walmart. Walmart’s growing share of Gen AI referrals in the chart matters: it is winning a small but high‑intent channel that is compounding quickly, while Amazon’s resistance to AI scraping risks trading today’s data moat for tomorrow’s demand moat.

Amazon, meanwhile, is ceding relative share in the stack as more of the incremental AI-driven clicks flow to competitors like Walmart, Temu and AliExpress.

Throughout 2025 Amazon has steadily expanded its robots.txt blocklist to keep AI crawlers from Meta, Google, OpenAI, Anthropic, Perplexity and others off its site, explicitly trying to stop models from training on or browsing its eCommerce data.

That might protect short‑term data moats, but it also means many shopping agents, comparison copilots and answer engines see less Amazon inventory, fewer offers and weaker price signals when they build their recommendations.

Walmart’s “open” bet on AI discovery

Walmart has not taken the same aggressive, public stance against AI crawlers in robots.txt and has become a favorite dataset for third‑party tools, scrapers and analytics platforms that help power AI‑driven shopping and GEO (Generative Engine Optimization).

By allowing more structured access to its catalog and pricing signals (within its own anti‑bot guardrails), Walmart is effectively treating Gen AI platforms like the next generation of search—places where being “most visible” beats being “most protective.”

Does Amazon care?

In my view, not yet. Gen AI referrals convert at a very high rate, but the absolute volume is still tiny and remains a rounding error next to legacy channels like search and social. Even with triple‑digit year‑over‑year growth, AI traffic still pales in comparison to Google, which sends roughly two orders of magnitude more clicks than AI platforms today. When will they care? Tough to say but the deals to spend $38 billion on AWS and an investment and invest. $10 billion in OpenAI will certainly grease the skids. At this point, Walmart has more to gain than Amazon does.