Why are the likes of Amazon and Google so heavily investing in same day and next day shipping? One reason, traffic and buying shifts to stores as the holiday approaches. Take a look at the order volume November (red line) vs. December (blue line) as Christmas approaches for one of our brands. The days of the month are the horizontal axis:

Holiday Inflection Point

With this year's total retail sales expected to be up 3%, there is only so much growth to go around. With the stats from RetailNext on store sales, it seems as though everything has gone to eCommerce thus far:

Sales at physical stores fell 6.7% over the most recent weekend, while traffic declined 10.4%, according to RetailNext, which collects data through analytics software it provides to retailers. That is worse than the 5.8% decline in sales and the 8% drop in traffic recorded from Nov. 1 through Dec. 14.

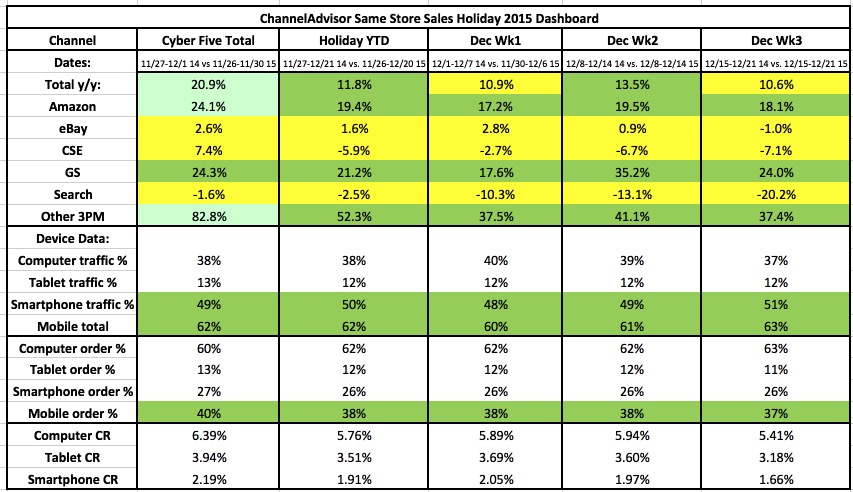

Within eCommerce, Amazon has been the clear winner according to ChannelAdvisor. Google is seeing high growth in Google Shopping but that growth is largely as the expense of their lucrative Google Search business:

Revisiting "The New Normal" of Retail in 2015

Last year, I outlined "The New Normal" of Retail which largely focused on increased mobile usage, small stores and more immediate shipping. I thought it would be worthwhile to outline 2015 prior to releasing 2016 predictions later this week:

eCommerce

- 2013: Strong eCommerce growth with flat store sales

- 2014: eCommerce growth strong enough to offset negative year over year store sales

- 2015: Many traditional retailers saw weak year over year sales as store sales losses were only partially offset by eCommerce sales

Mobile

- 2013: Mobile visitors account for 25% of traffic and 10% of sales

- 2014: Mobile visitors exceeding desktop visitors and contributing 30% of sales (contribution)

- 2015: Mobile visitors now exceed physical visits

Shipping

- 2013: "I'm not paying for shipping"

- 2014: "I want it now and I'm not paying for shipping"

- 2015: "I want it now and if I decide to pick it up at the store, I should have dedicated parking and no queue."

Fulfillment

- 2013: Big box retailers shipping from stores.

- 2014: Big box retailers shifting selling space and payroll to fulfillment space and payroll.

- 2015: Capital expenditures shift to distribution centers and outlet store openings.

eTail

- 2013: "All commerce is shifting to eCommerce"

- 2014: "When is this lease space available?"

- 2015: "Buying sales is expensive, time for layoffs."

Beacons

- 2013: "Tracking is an invasion of privacy"

- 2014: "The bridge of offline and online retail"

- 2015: "We are waiting until Google allows for app-less engagement."

Social

- 2013: Retailers sharing links on social media sites with off app/site transactions.

- 2014: Twitter, Pinterest, Facebook, Wanelo transactions happen in-app/site.

- 2015: No posts are "free," everything is sponsored.

NYT: "Turning Point for Video Game Industry"

Over the past 6 months I have posted why Gamestop's toughest years are ahead, why Gamestop is the IBM of Retail and signs that digital downloads are at an inflection point. Today, the NY Times reiterated a lot of the same thinking:

A number of factors are at play, but none as significant as the industry’s march toward a future of games downloaded over the Internet rather than bought in stores, analysts said. All mobile games are delivered over the Internet, as are nearly all PC games. But the transition for console games — the biggest segment of the business — has been far slower. Large game files could take hours to download and quickly fill a console’s hard drive.

Now, faster broadband speeds and the bigger hard drives in the latest generation of consoles are reducing those obstructions.

I still believe this is the tip of the iceberg and faster broadband speeds are only one reason consumers are flocking to digital downloads. Early release windows, early trial periods, game incentives and ease of purchase are all reasons as to why customers prefer digital downloads. Publishers will continue their assault on the retailers for a few reasons:

- Publisher Take Increases: The Publishers make money by selling directly to the consumer through the consoles.

- Used Game Market Is Minimized: The more digital downloads the lower the amount of used games that can take away from new purchases.

- Owning the Customer Relationship for Future Marketing

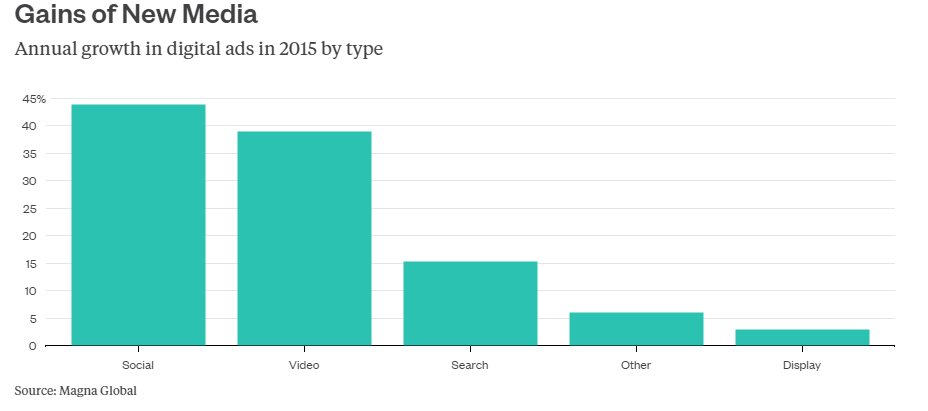

Digital Ad Growth

Bloomberg recently posted a few charts on the growth of digital ads vs. traditional ad formats:

Digital is expected to become the biggest global ad segment by 2017, beating out the category's king, television, according to new Magna Global data. Currently, 38 percent of global ad spending is on TV, while about 32 percent is digital.

Global ad revenue will be about $503 billion this year, according to Magna, and is expected to increase to $544 billion in 2017.Digital media saw the largest increase in ad sales this year among competing platforms, with a growth rate of 17.2 percent. Newspapers and magazines had decreases (-8.6 percent and -10.1 percent, respectively). Growth on other advertising platforms, including TV, was basically flat. Mobile currently makes up about a third of all digital ad spending; it’s expected to be nearly half of the total digital spend by 2017.

Cross Border Commerce: Canada

Day trips into the United States this year are down 26 per cent, rivalling some of the sharpest drops on record. The loonie’s historic slide over the past year or so “has completely reversed the tide of cross-border shoppers,” Sal Guatieri, economist at Bank of Montreal, says.

Amazon Logistics

Per the Seattle Times, Amazon is looking to lease more than just trailers:

Amazon.com is negotiating to lease 20 Boeing 767 jets for its own air delivery service, cargo industry executives have told The Seattle Times.

Leasing 20 jets would be a significant expansion of an Amazon trial operation out of Wilmington, Ohio, according to sources. A cargo industry source said Amazon expects to make a decision to go beyond the trial run and pull the trigger on a larger air cargo operation by the end of January.

The cost of the operation wouldn’t be cheap either. Leasing newly built Boeing 767F jets runs to $600,000 to $650,000 a month, according to cargo industry experts. With so few of those jets available, Amazon would likely turn to lease partners to pick up used converted freighter jets. Those cost about $300,000 to $325,000 per month to lease.

Can't stop, won't stop.

Half of online shoppers check Amazon most of the time...

Although only 800 survey results, couldn't resist how important Amazon is to the online shopper journey:

Consumers were asked how often they search for products or check prices on Amazon when they shop online. Some 24 percent of online shoppers said “always,” and another 25 percent said “most of the time.” That means Amazon has managed to lure some 49 percent of online shoppers to consistently consider their site. (And still another 26 percent said they “sometimes” search Amazon.)

Streaming Video > Commercial Broadcast Networks

Netflix led all television networks with eight nominations Thursday, besting traditional awards-season beast HBO by one nod. Just as significant were advances made by Amazon and Hulu. The former drew five nominations, following last year’s first nods and wins for “Transparent.” The latter netted its first nomination, for the Jason Reitman-produced comedy series “Casual.”

Together, the three streaming services drew 14 nominations — five more than the commercial broadcast networks combined.

Congrats Netflix, Hulu and Amazon Video. Quality coupled with a better experience at a lower cost.

Owning Ecommerce First Page Search

I previously posted how Amazon is the mobile "Commerce Point of Entry," owning 45% of searches for products on smartphones. L2 reported that last week Amazon also dominated the first page of search within each of the top categories. Some fantastic charts illustrating their dominance in a few categories:

Slow & Steady Wins the Race

Bitcoin approaching $400 again while transactions continue an upward trend.

Amazon Drone Update

How believable? Somewhat.

With that said, amazing use of their newly signed talent, Jeremy Clarkson with a UK theme to pressure US FAA officials.

What a difference 26 years makes. Shanghai.

Same Day Shipping for 76 Million People

Amazon.com Inc. has a new, expensive-to-reach target in its quest to sell everything to everyone: last-minute holiday shoppers.

The online store has spent the past year expanding its same-day delivery service to 24 metropolitan areas covering a population of 75.7 million people, or almost one in four U.S. residents, according to data compiled by Bloomberg. One option—Prime Now—gets products to customers in an hour or less.

Finland & Smartphones (Nokia) = Switzerland & Watches

The headline may seem a bit obnoxious but I truly believe we are starting to see the start of a significant decline in the world market share of Switzerland and watches. The weakness depicted below is largely due to a contraction in the growth rate of the Chinese economy with Swiss exports of watches in the first 10 months of 2015 only down 3.2%.

However, that weakness comes at a time when active watches are on fire and smart watches are improving. Active watches would be those offered by Fitbit or Jawbone that offer to tell the time whilst tracking sleeps and steps. Why does a consumer need both a watch and a step counter that tells time? They don't. Secondly, consumers of today have very different purchasing habits. Consumers spending habits are flat to slightly down but the frequency of purchases are up considerably. Retail stalwarts like H&M, Zara and Uniqlo have become fast fashion global goliaths exploiting the trend of frivolous, throw away purchases. As for smart watches, Apple's first foray is a drop in the bucket today, but will grow quietly. Additionally, Android's host of Android Wear manufacturers (Samsung, Motorola, LG, etc.) will continue to improve their offerings for Android's 60%+ global market share.

The first 10 months of 2015 are the start of a trend that should have those in Switzerland worrying.

Q3 Ecommerce Census Growth

Census released the Q3 numbers on ecommerce. As a % of the total retail sales, ecommerce now makes up 7.4% which is up from 7.2% in Q2. Growth is back above 15% with sales in Q3 jumping 15.1% vs. 14.3% in Q2.

Next number to focus on is Cyber Monday which is expected to grow 12% year over year to $3 billion.

Inflection Point for Digital Downloads?

In previous posts I have asked Can Gamestop Survive and called Gamestop the IBM of Retail. This past week, an NPD report came out stating that retail video game sales declined 3% year over year in October. This result was despite a number of high profile games like Halo 5 and NBA 2K16 being released. Cowen analyst Doug Cruetz had expected a 34% increase and had the following to say:

"'Halo 5' sold less than half of the units we were modeling, accounting for almost half the miss in our overall number," Creutz said. "Since Microsoft has already announced that 'Halo 5' is the fastest-selling 'Halo' title of all time, and even allowing for some variance in release date timing and such, this suggests to us that at least half of 'Halo 5''s non-bundled unit sales were digital."

Might this holiday season be the inflection point for digital downloads we have been anticipating? It will be interesting to see the digital vs. physical sales of Activision's latest Call of Duty and the upcoming Star Wars: Battlefront from EA. One thing is for sure, the more digital downloads, the better for publishers and worse for Gamestop and retailers.

Holiday Shopping Survey Findings

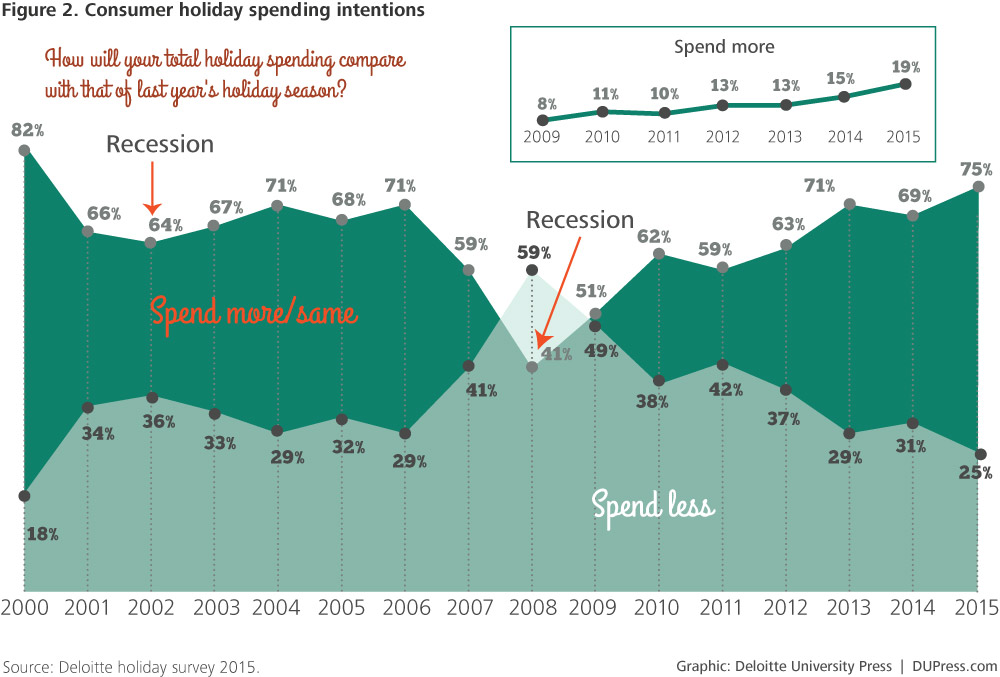

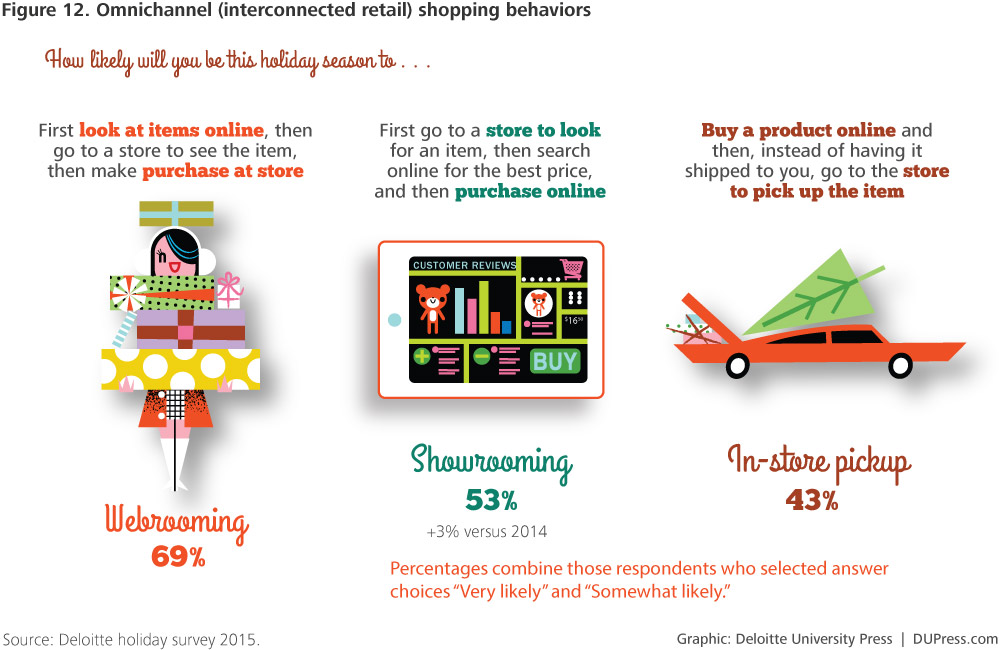

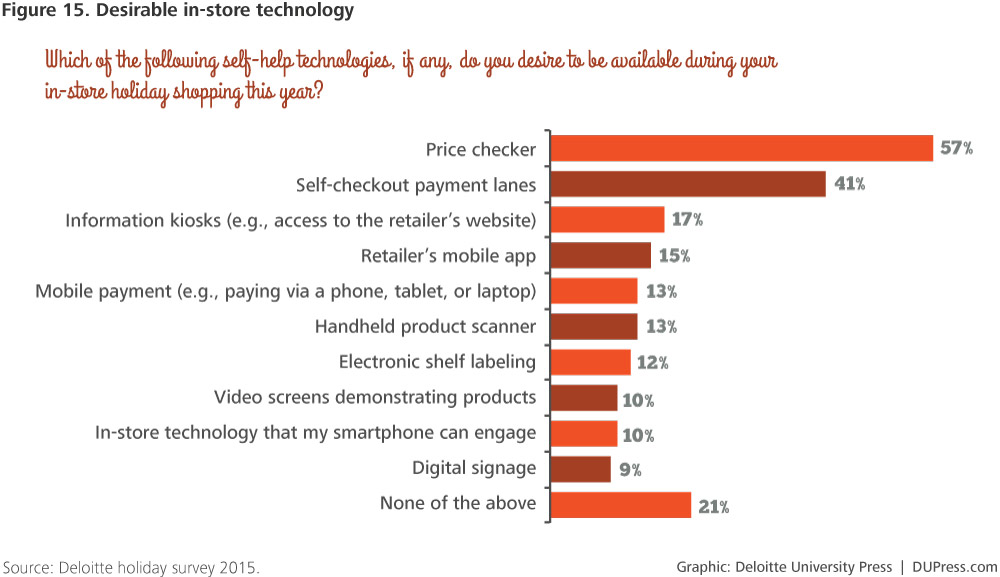

The recent Deloitte Holiday Shopping Survey had some interesting findings:

- 19% of shoppers intend on spending more than the previous year due to 41% of respondents being in a better financial situation

- Most favored format is the Internet for shopping at 47% (up from 45% in previous year)

- Omni-channel behaviors will dominate with 63% webrooming, 53% showrooming and 43% buying online and picking up at store

- Free shipping is more important than fast shipping (87% vs. 13%) and fast shipping is defined as a maximum of 3-4 days for the overwhelming majority

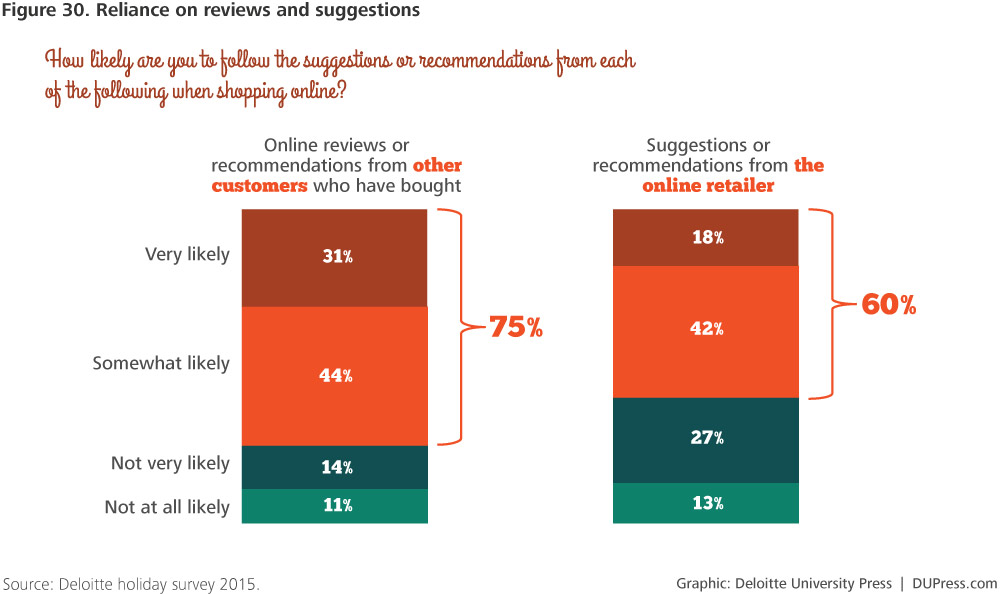

- At least 75% of shoppers are somewhat likely to follow suggestions to purchase based upon other customer product reviews

10 Billion Yuan in 38 Minutes

November 11, also known as Singles Day, the largest global ecommerce shopping day largely celebrated in China has become Spending Day.

Much of the buying takes place online. On November 11th last year, Alibaba, an e-commerce company, sold 57.1 billion yuan ($9.3 billion)-worth of goods; the first 10 billion yuan-worth was sold in just 38 minutes. This far eclipsed the $1.5 billion spent online by Americans on “Black Friday”, the day after Thanksgiving, which in the United States has become the biggest spending day of the year online, thanks to steep discounts.

Close to $10 billion in GMV in 38 minutes. Astonishing.

Walmart Buy Online, Curb Pickup

Walmart has been on the offensive with the launch of pickup stores using dedicated parking spaces. Initial launch was small but has since expanded to 23 markets with another 20 to be added early next year. The offering now extends into mobile with an update Walmart app that allows the customer to inform Walmart associates when they are due to arrive or are in close proximity. The hope is that by better understanding customer arrivals, wait/queue times will be reduced. Look for Walmart to eventually use beacons or other tech for automated customer arrival updates. This type of offering was previously available as part of Square Order.

This is just another example as to how retailers worldwide will be forced to turn stores into fulfillment centers which drastically alters staffing, sales floors, traffic patterns and the merchandise.