Google Evil has become the focus of media outlets yet I find that very few rational viewpoints on the position we are in with Google and how Google came to be in this position. Benedict Evans summarized it well:

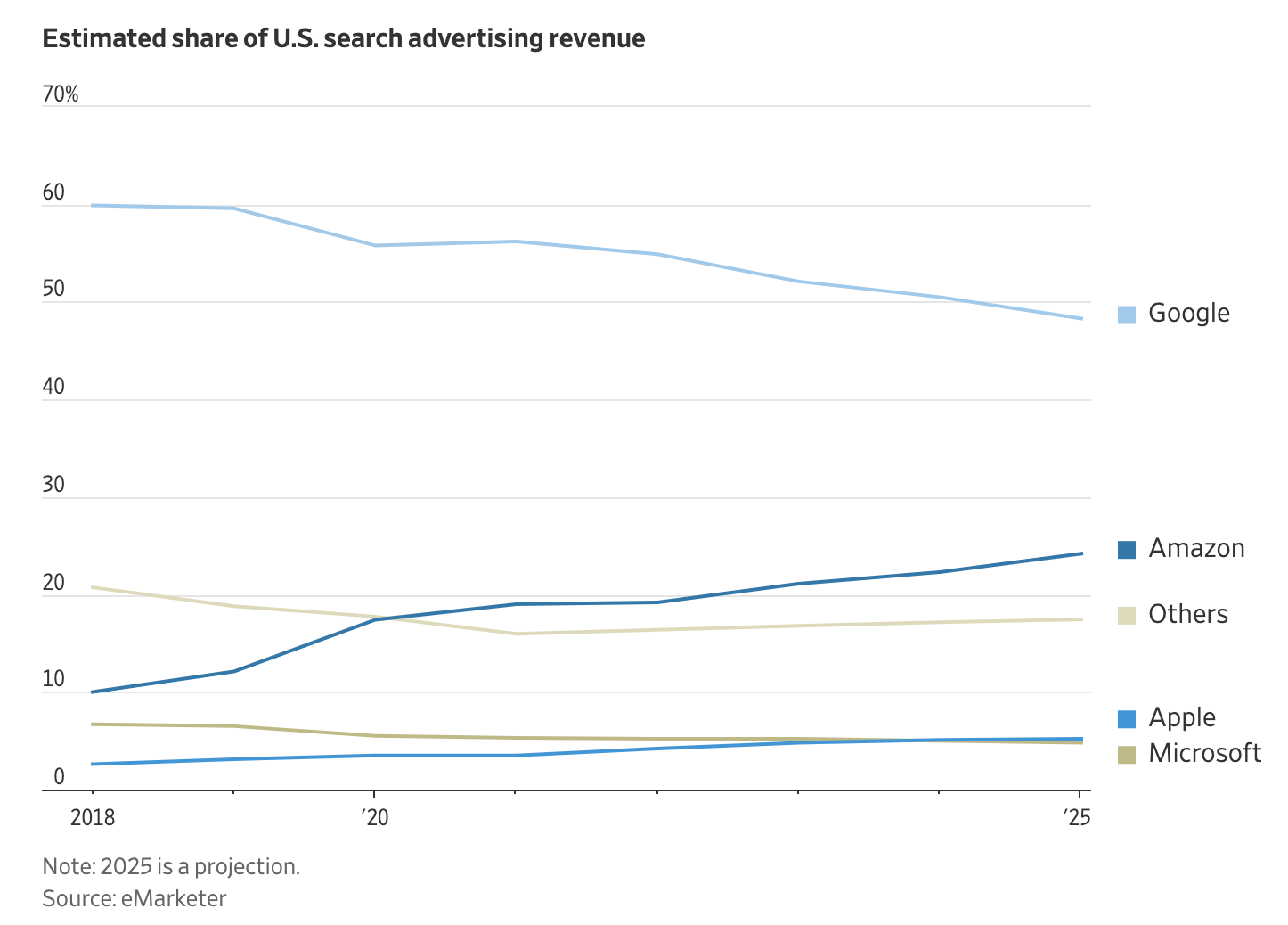

However, there's another virtuous circle: everyone uses Google because it's the default, it's the default because it’s the best and because Google pays other tech companies billions of dollars a year in revenue shares as ‘traffic acquisition costs’ (TAC) to make it the default, and it’s the best and Google has those billions to pay because everyone uses it. In 2022, Google paid Apple about $20bn (about 17.5% of Apple’s operating income, and a 36% revenue share) and other companies $10bn to make it the default, which was close to 20% of Google’s search advertising revenue. And this was the center of the US competition case that was decided this week.

We all knew this in theory (after all, the TAC is right there in the accounts), but this week’s judgement made it a lot more tangible. 50% of search in the USA happens on channels where Google has a contract to make it the default: 28% on Apple devices, 19.4% on Android (the OEMs and telcos decide the default on Android, not Google) and 2.3% on other browsers (i.e. Mozilla) - and then another 20% happens in user-downloaded Chrome on PCs. (Amusingly, the contract means that Google pays Apple even for searches done in Chrome on Apple devices.)

While anecdotal, who do you know that changes the default search engine? It seems very few. Take a look at at the share of Edge and IE which are the few browsers that start without Google.