Recently I have been following what I believe to be a potential Groupon ($GRPN) turnaround. Yes, that Chicago based couponing deal site that was once run by Andrew Mason and thought be a major competitor to Amazon someday.

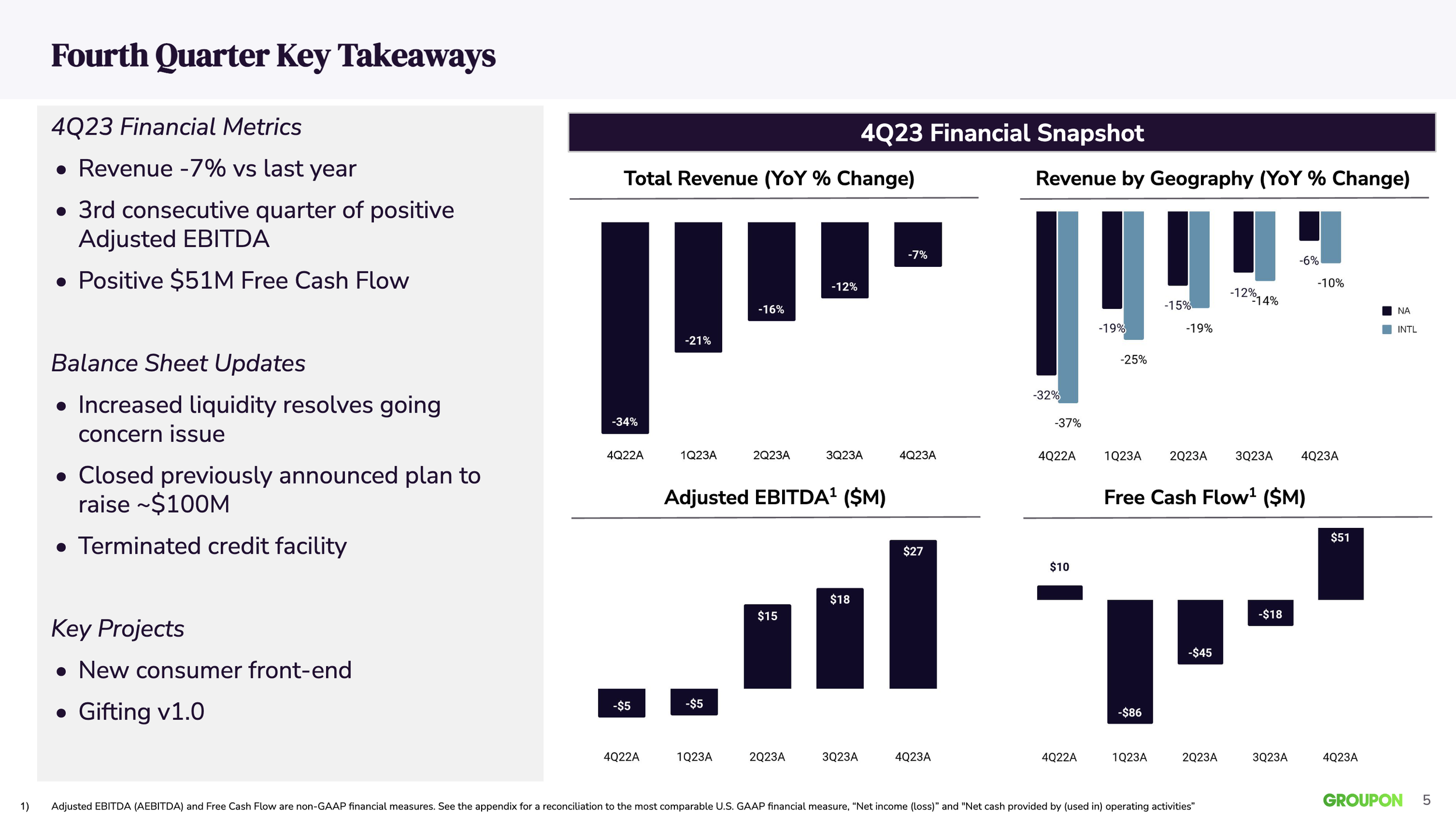

Why the interest? The management team seems focused on all the right things and the numbers are improving. Just take a look at the latest quarter’s results. Revenue declining at much lower rate, EBITDA growing and free cash flow now positive.

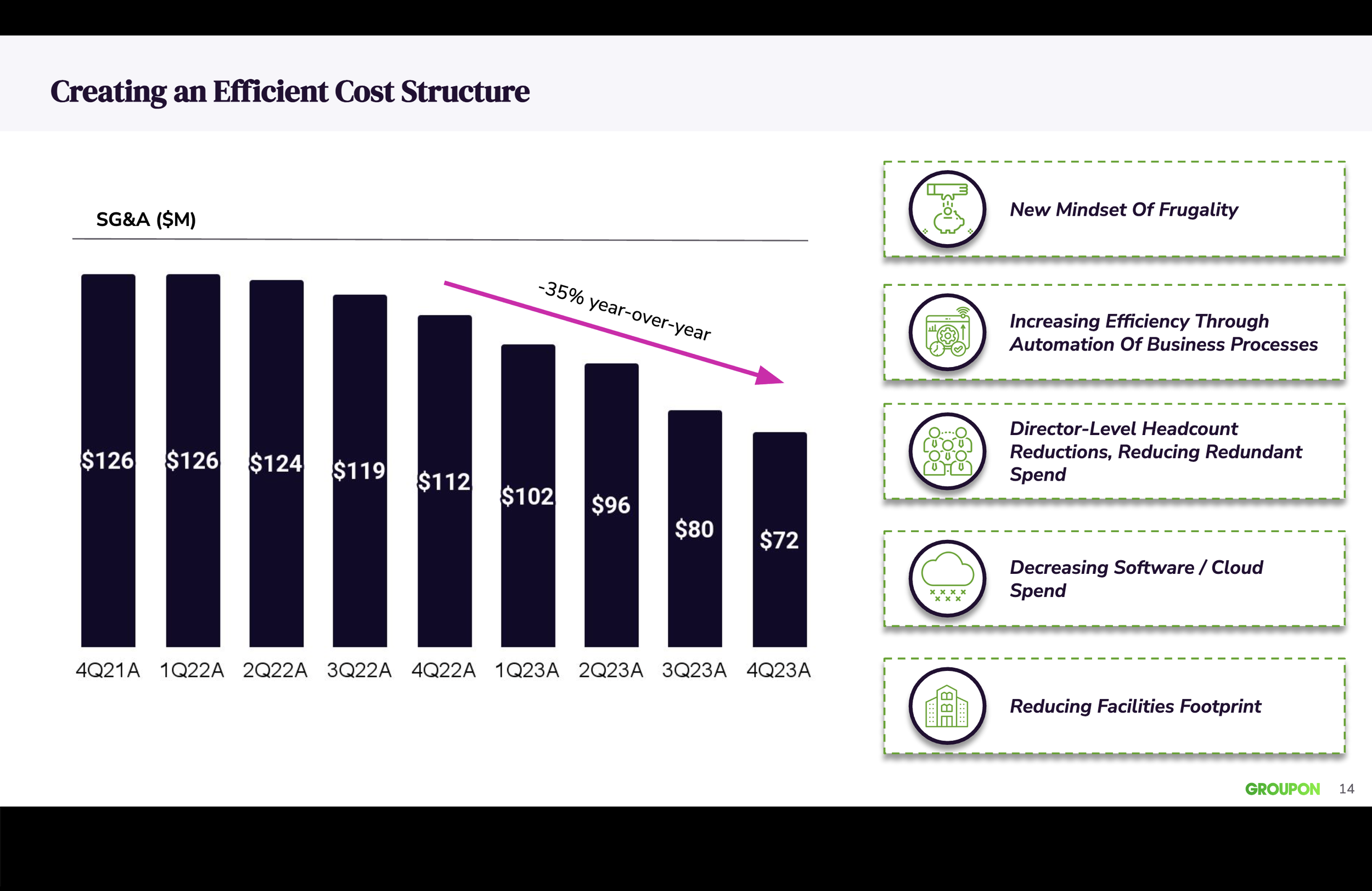

The improvement in financials doesn’t stop there. SG&A continues to decline considerably and marketing has been right sized with mindset of frugality.

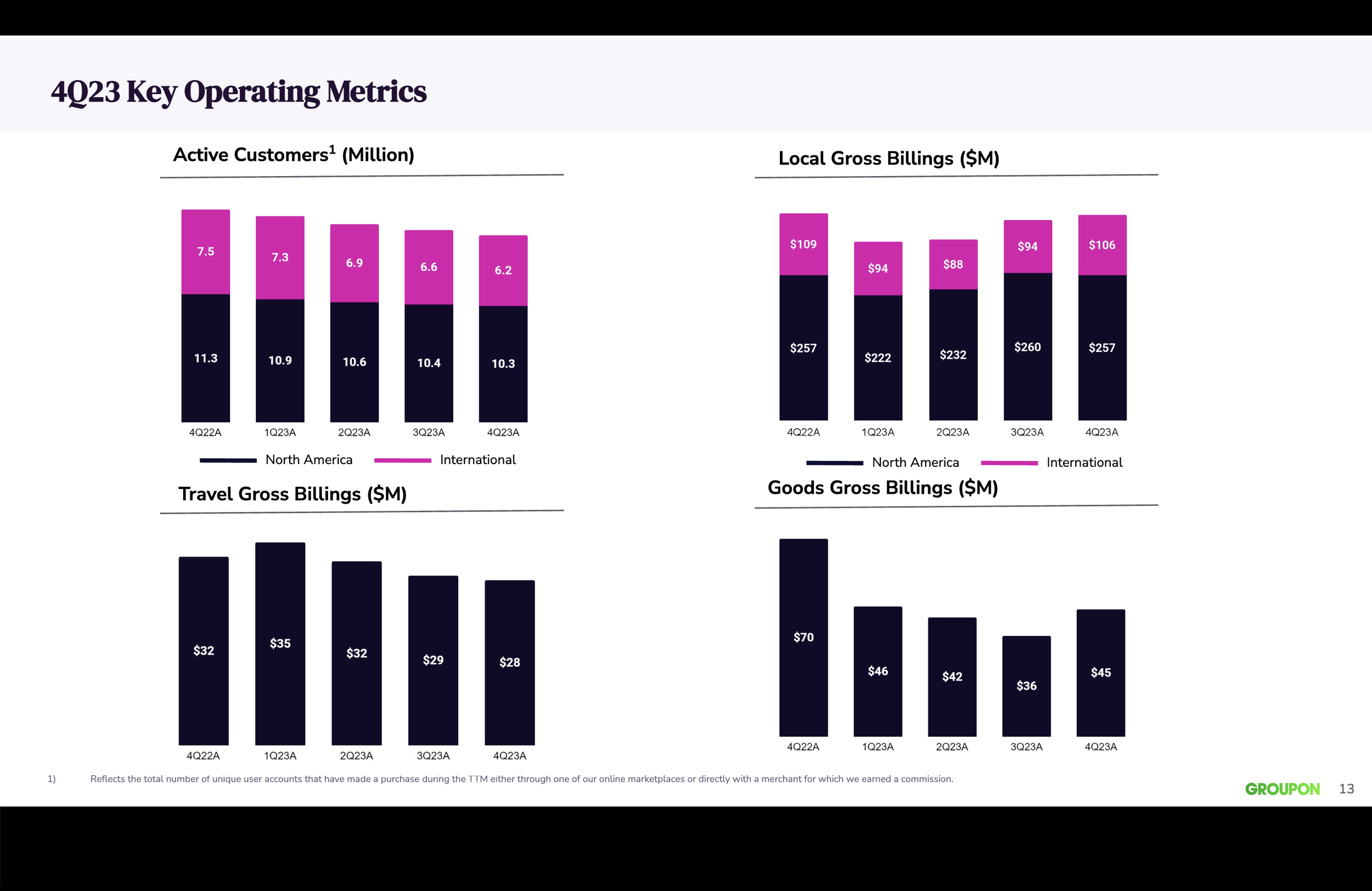

Despite all the positive trends on the financial size of the business, the active user base declines do have me worried a complete turnaround is possible.

However, I still find the management to be focused and results are clearly on the mend. I have personally been in and out of the stock over last several months and plan to initiate another position. Guidance for 2024 calls for flat to slightly down revenue, positive cash flow and positive adjusted EBITDA. This could be a Groupon comeback we are witnessing.