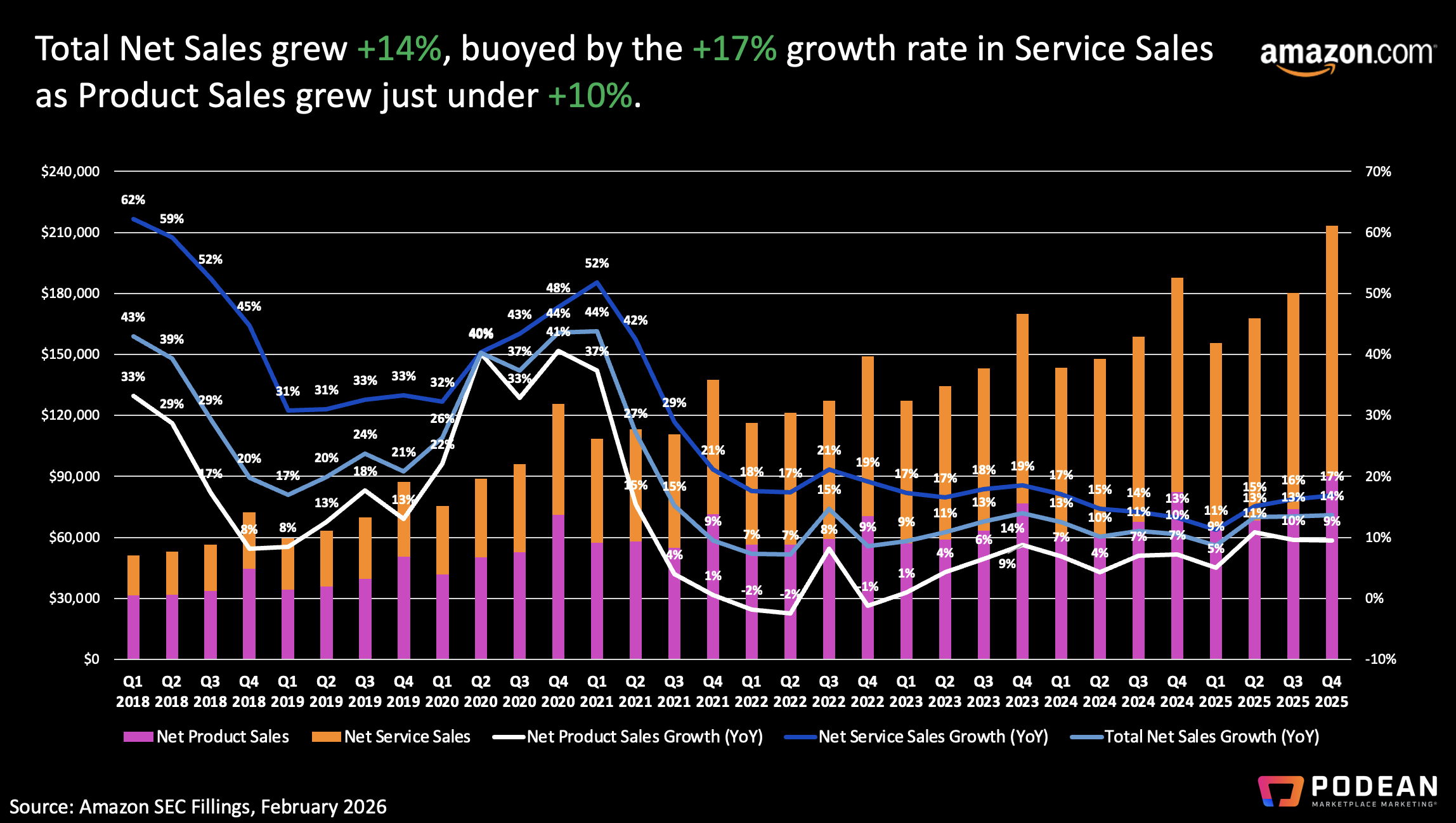

The close of fiscal year 2025 for Amazon shows much of the same from prior quarters. A continued acceleration in the services business with AWS growing 24% year-over-year as Advertising and Third-Party Seller Services each drove double digit growth. Although the margin was difficult in international markets, the North America market margin exceeded expectations despite inventories growing a bit faster than retail sales. Here are the key highlights:

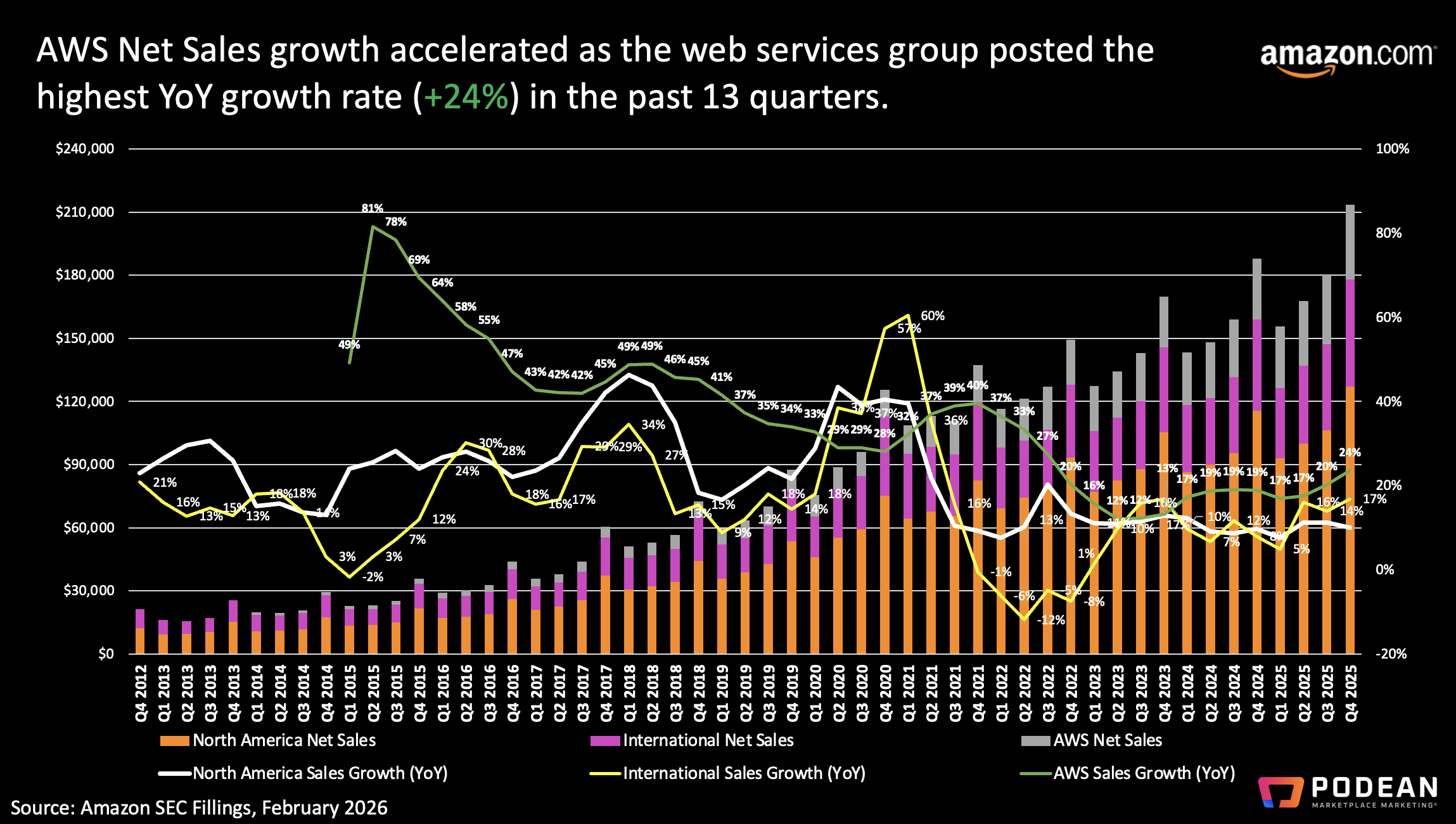

AWS Accelerates Above Expectations

Amazon Web Services (AWS) grew 24% year-over-year, outpacing consensus and adding $6.8 billion in incremental sales. AWS continues to capitalize on the industry-wide shift toward cloud and focus on AI, with Google and Microsoft also reporting healthy gains, albeit from smaller bases. The growth rate was the best AWS has seen in 13 quarters.

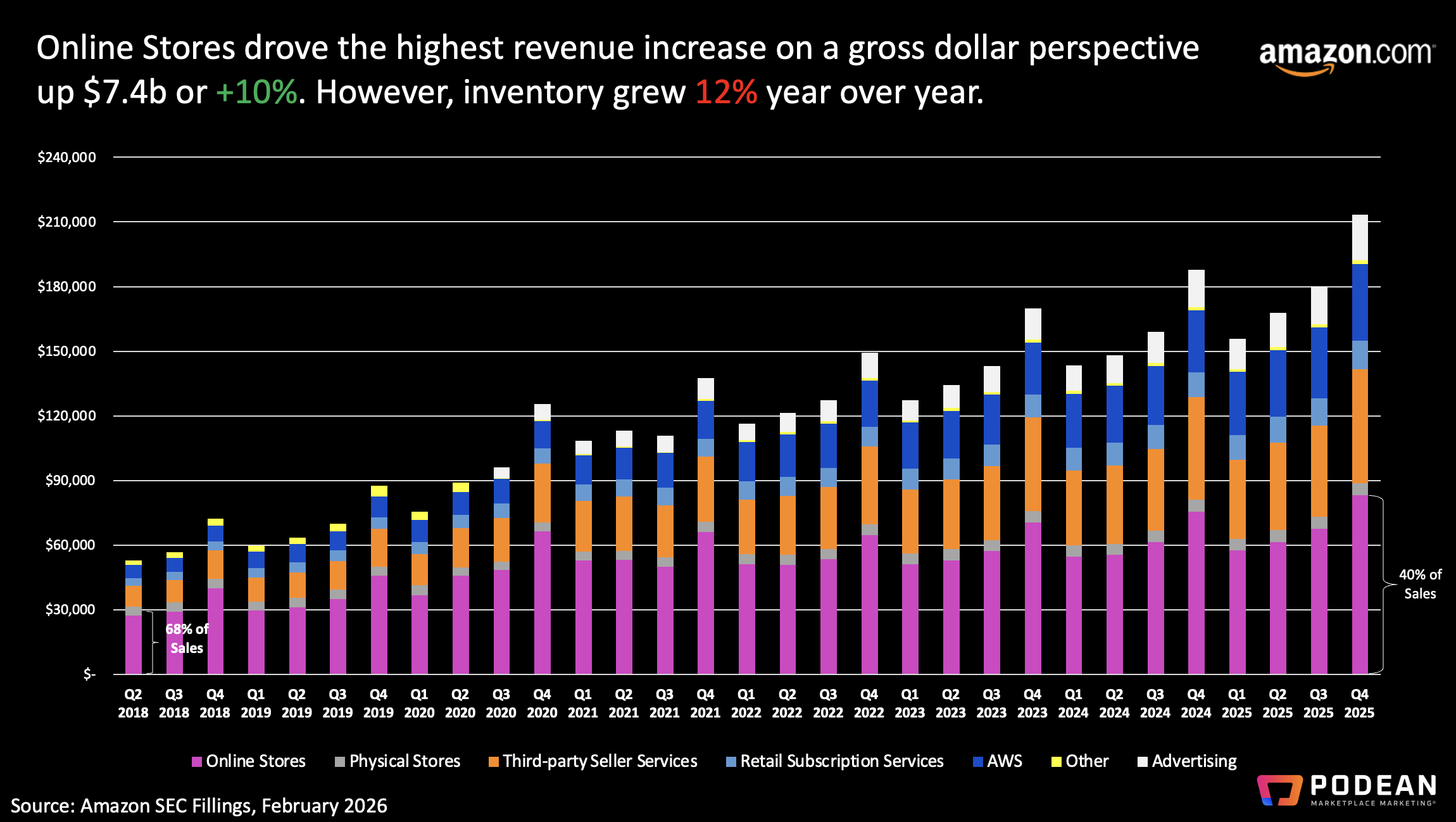

Marketplace and Seller Services Fuel Growth

Third-Party Seller Services delivered a second third consecutive quarter of double-digit growth. Since Amazon takes a referral fee from these transactions, strong 3P sales signal not just higher volume but greater pricing power. This business now accounts for nearly 25% of the overall net service sales.

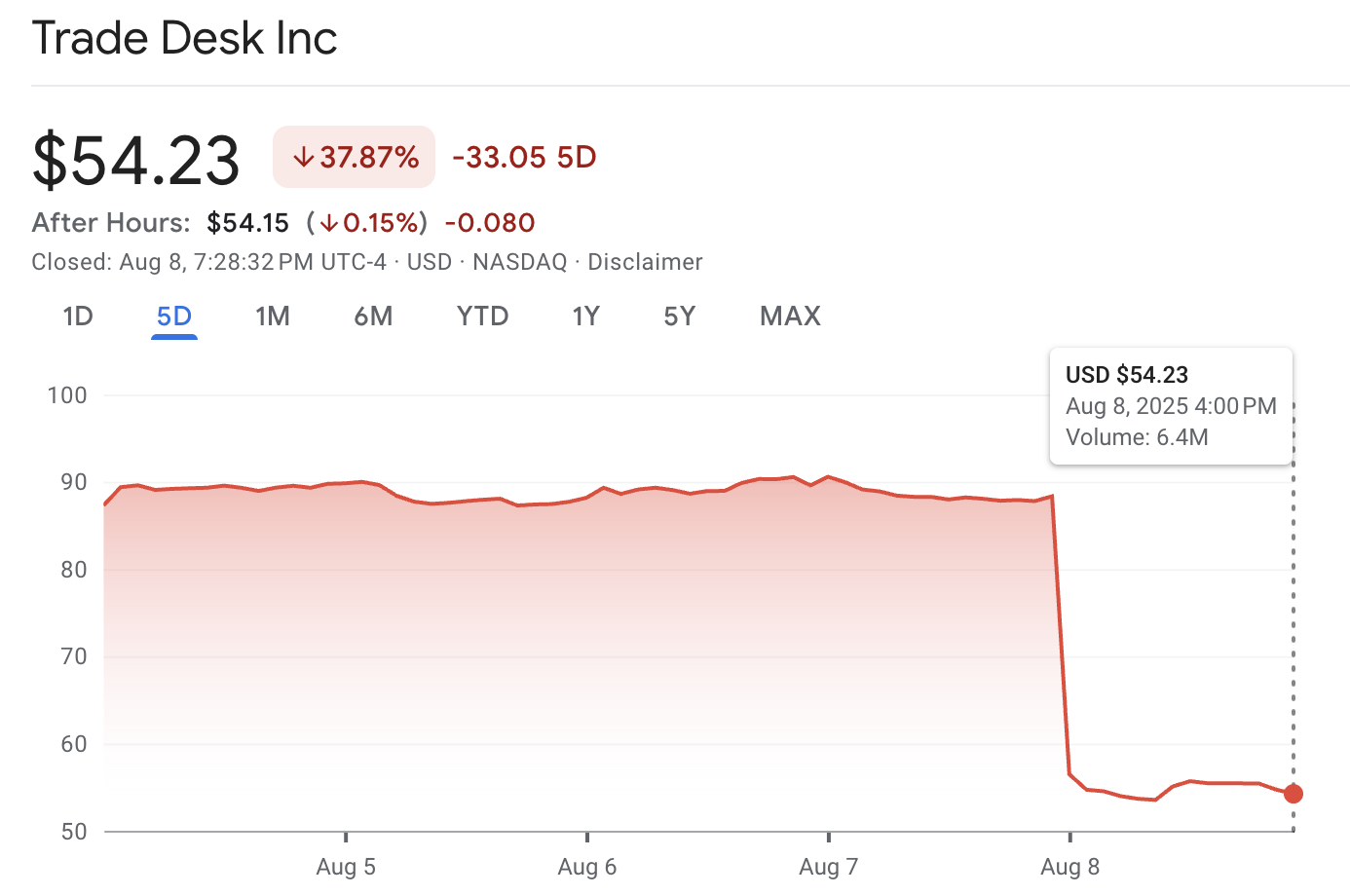

Advertising Revenue Momentum Continues

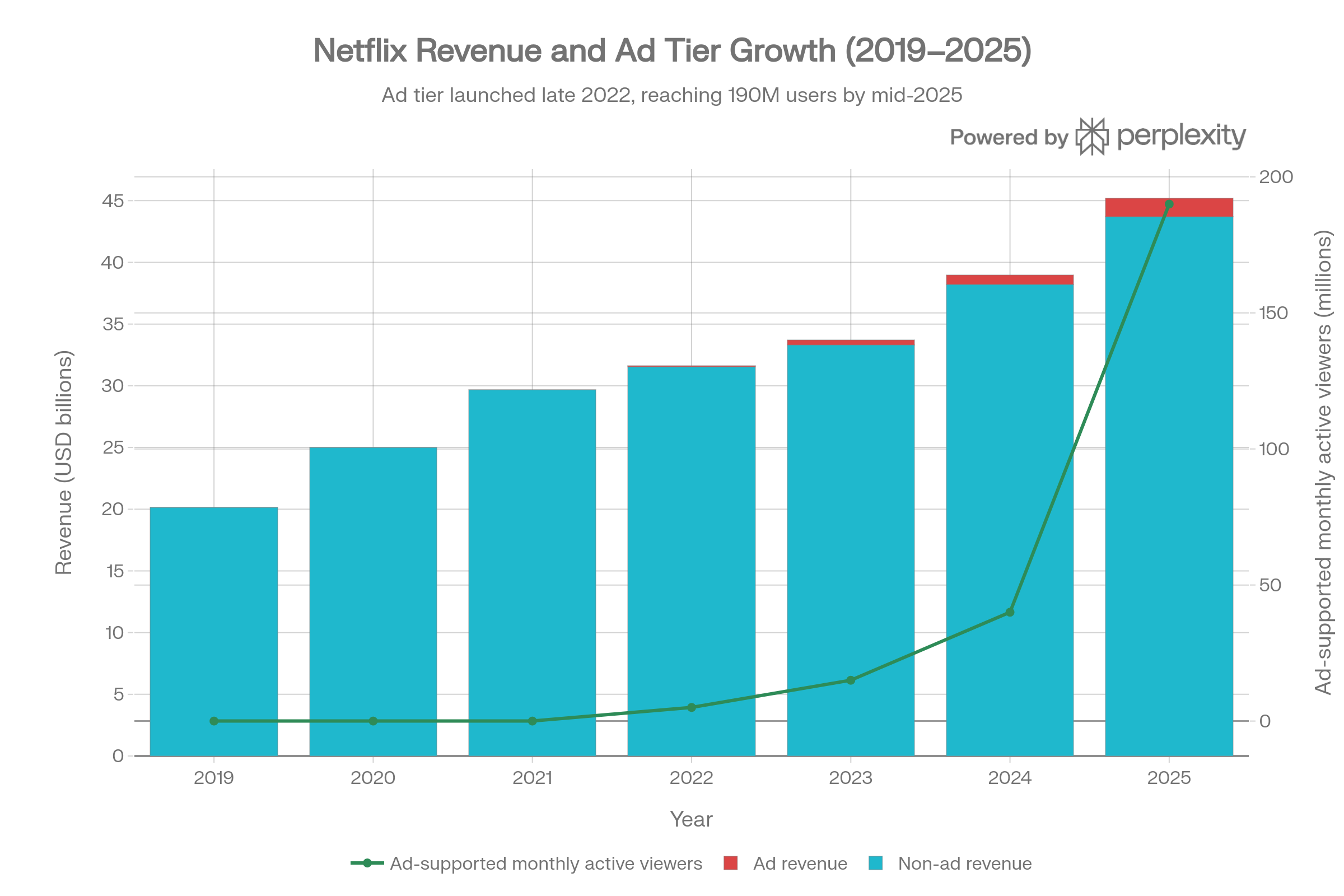

Amazon's advertising business grew 24% this quarter, building on last quarter's 24% growth. This surge comes as Amazon steadily grabs market share from rivals like The Trade Desk, strengthening its position as a key force in digital marketing. Key partnerships with players like Netflix, Roku and Spotify should keep this key source of revenue growing for future quarters.

Online Sales and Inventory Imbalance

Core online sales rose just under 10%, nearly hitting the third straight quarter of double-digit growth. However, inventory levels climbed even faster: up 12% this quarter and 14% in Q3 and 19% in Q2. While the pace of inventory accumulation is slowing, the overhang remains. This imbalance points to elevated pricing and stepped-up vendor funding as Amazon seeks to convert heavy inventory into margin gains.

Amazon's latest results underscore its ability to CONTINUE to grow both the top and bottom line-even as the retail landscape remains fiercely competitive and inventory levels remain in focus. Although the market is spooked by the $200b in planned capital expenditures, nothing here suggest Amazon slowing anytime soon.