Hudson's Bay is a retail juggernaut owning Lord & Taylor, The Bay, Home Outfitters, Saks, Saks Off Fifth, Gilt and Kaufhof in Europe. My first role with the company took place in 2009 to 2011. At the time, I was a consultant working for Accenture when I was first introduced to Lord & Taylor as a client. Our mandate was to provide the brains behind the ideas for merging Lord & Taylor with Hudson's Bay. After the Hudson's Bay acquisition took place, we were focused on using our larger scale to drive cost efficiencies and savings from vendors through larger, more optimistic contracts. Eventually we would provide support to Hudson Bay's Zellers team to ready the stores for handover to the short lived Target Canada and determine the best way to position Canada's leading department store, The Bay.

At some point in 2012 after I had left for several months, I was approached by HBC Senior Leadership to leave the consulting lifestyle and officially join the front lines of the industry I was so passionate about. Over the course of the next two years, I provided strategy support to the President, fought vigorously for digital initiatives and even MC'd the company's annual leadership summit. Up through 2014, it was a fantastic four years that serves as the foundation for my retail knowledge and relationships I use each and every day. Working as both a consultant and leader within a company with goals of becoming the world's largest department store operator was a blessing.

Unfortunately that goal brought about Thursday's news. Did retail really change that quickly? No. Internal meeting topics back to 2013 included ideas and strategy questions that the media talks about today. Should we downsize as productivity declines? Should our stores shrink in size? Should we fulfill our internet orders from our top stores or our lower performing stores? Should we kill our print catalog and shift that money to digital ads? Should we open more stores to fuel sales growth? Will global brands like Zara and H&M continue to steal share? Is off price the new model?

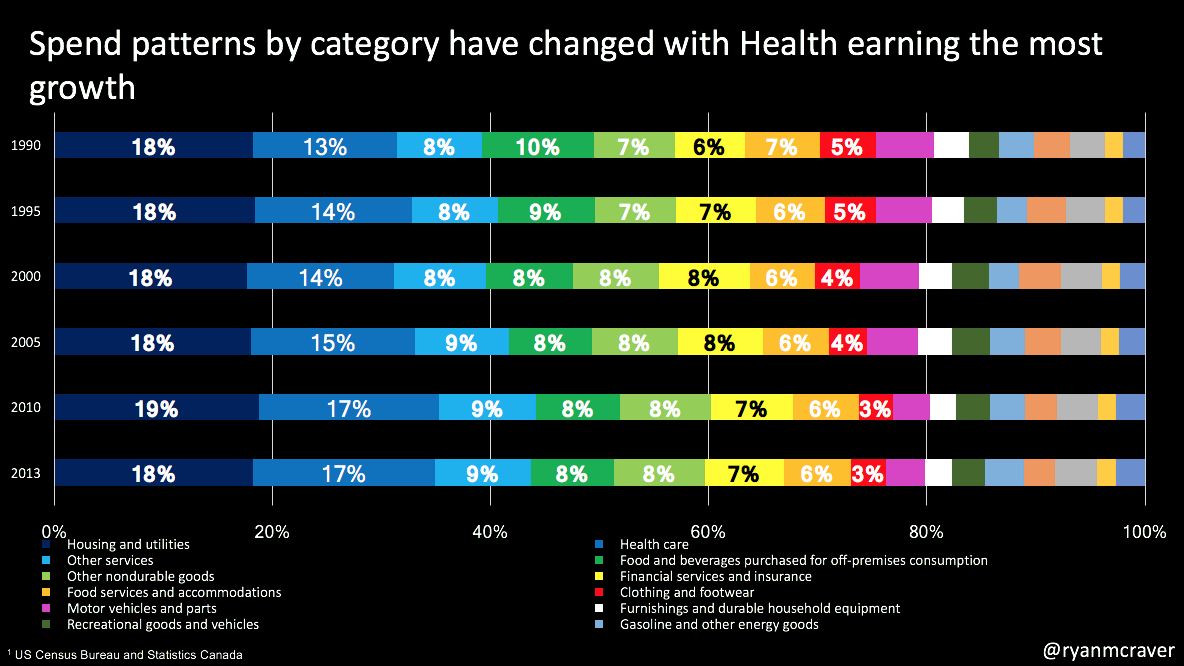

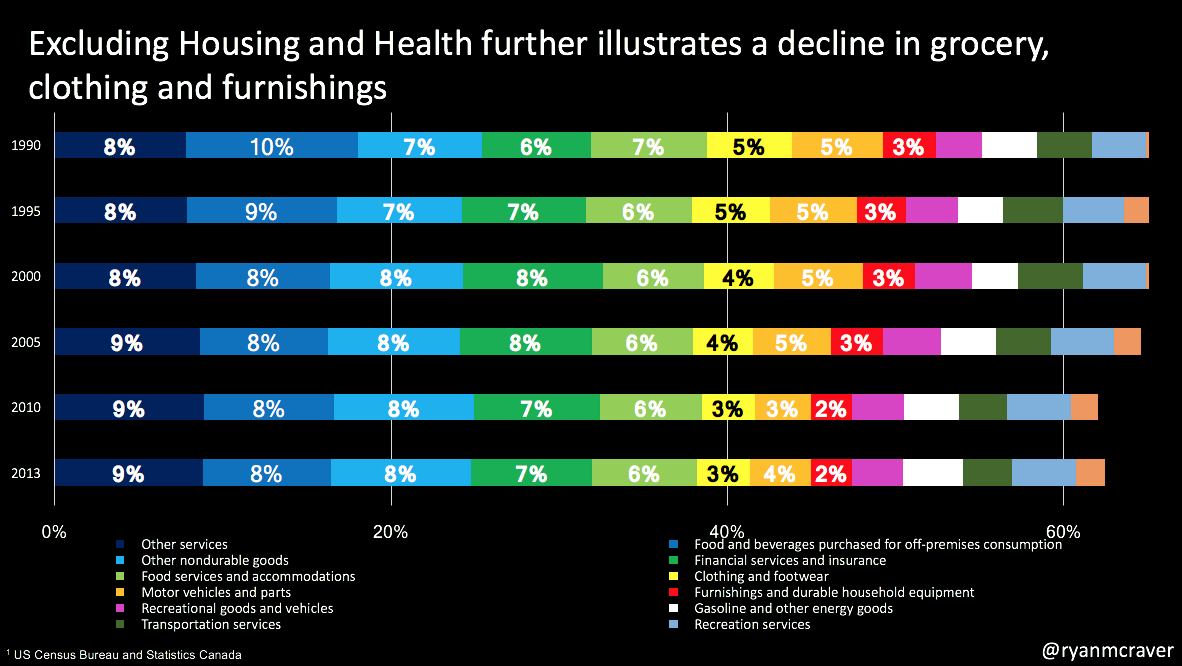

In actuality, retail is quite healthy and continues to grow at a modest 2-3% each year. Retail spend isn't without it's issues as healthcare and housing expenses have grown but the customer expectations and shopping habits have changed. Pockets of healthy growth are clear in fast fashion, brands opening their own stores, off price stalwarts like TJX and the shift to online spending.

So why do retailers continue to pick the option that is in the best interest of the short term? Growth drives the world. Without growth, investors become displeased and the stock trades down. Without growth, employee morale suffers and focus is lost. Investing in digital, closing stores and shrinking stores kills growth in the short term. This is why Nordstrom is interested in going private. Wouldn't it be great to not have investors from the outside questioning your investments into the business?

Legacy retail must be reminded that business is always tough and the next 5-10 years will be even tougher. Stores will continue to shrink, stores will continue to close, new entrants will continue to come knocking and shoppers will continue to shift online where less profit is made. The golden years of retail are long gone and disintermediation is here for the foreseeable future. Those legacy retailers making the difficult decisions to groom themselves for a smaller, more dynamic and leaner retail industry are the ones that will survive.