This comes off as a sponsored post but I can assure you it isn’t.

Over the last year, I have shifted a majority of my index investing in ETFs to direct indexing using Frec (referral) and Fidelity FidFolios. As you will in below, the case is quite compelling.

What is Direct Indexing?

Direct indexing is an investment strategy where you own the individual stocks that make up a market index—like the S&P 500 or Nasdaq—rather than investing in a pooled fund such as an ETF or mutual fund. With direct indexing, your portfolio is constructed to mirror the performance of the index by holding each underlying stock in the same weights. Thanks to advances in fractional share trading and automated platforms, direct indexing is now accessible to everyday investors, not just institutions or the ultra-wealthy.

For years, ETF investing set the standard for broad-market diversification at low cost. But direct index investing has changed the game. Instead of buying a pooled ETF, direct indexing means owning the actual stocks that comprise an index, unlocking major benefits in tax optimization and personalized control.

Why Direct Index Investing?

For years, ETF investing set the standard for anyone chasing broad-market diversification with low costs. But direct index investing has changed the conversation. Instead of buying a pooled ETF, direct indexing means owning the actual stocks that comprise an index, in the same proportions. This seemingly subtle shift unlocks major benefits, especially around tax efficiency and portfolio personalization.

The primary reason I believe so strongly in direct index investing is tax-loss harvesting.

When markets get choppy, some stocks within your portfolio will dip—even if the overall index rises.

Instead of selling an entire ETF and missing out on long-term winners, direct indexing lets you “harvest” losses from individual stocks, maximizing tax savings all year.

These harvested losses can offset capital gains elsewhere, or even reduce up to $3,000 in ordinary income each year. Unused losses carry forward, offering continued tax savings into the future.

Over time, this process—often called “tax alpha”—can boost your annual after-tax returns well beyond what’s possible with ETFs.

Unlike ETFs, which can “trap” losses at the fund level, direct indexing gives you full access to every potential write-off.

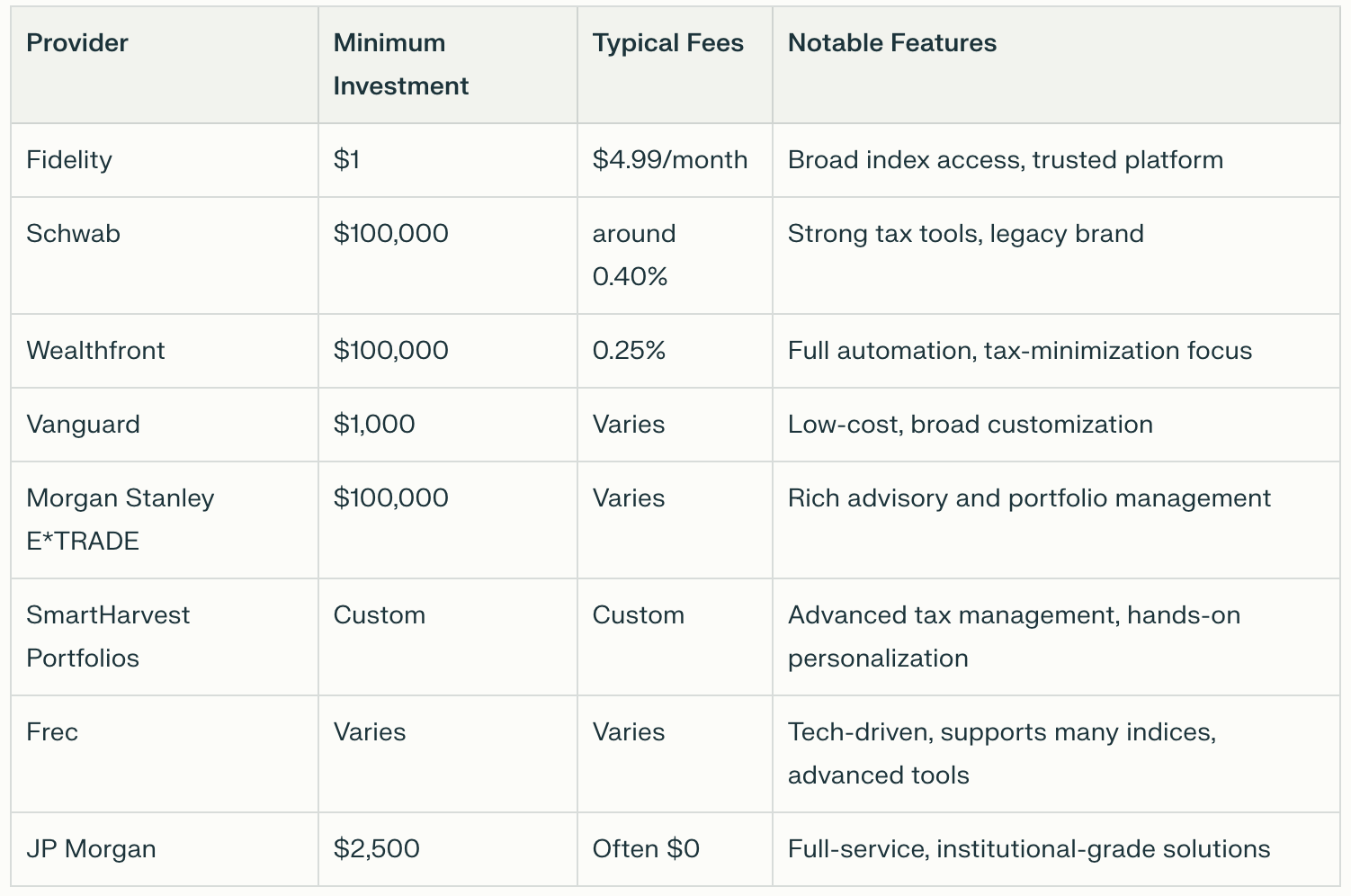

Which brokerages provide Direct Index Investing?

There are many but I have only used Frec and Fidelity FidFolios (international). I am a big fan of the Frec product and have even sought an investment in the platform with the founder. Fidelity I use for the broader international access.

Bottom Line: Direct indexing isn’t just about replicating the market; it’s about actively optimizing for tax efficiency and keeping more of your gains.