Just last week, Kohl's announced a partnership with Amazon to open 10 "smart home experiences" in the LA and Chicago area. Initial responses from the media and industry pundits ranged from, "why deal with the devil" to "Kohls is giving away the store on this deal." These types of headlines and views, remind me of all the retailers that have taken the "enemy" stance with Amazon. Some have succeeded. Whilst not completely attributable to Amazon, some have failed. Fast forward to today and Kohl's announced they will accept Amazon returns at 82 of their stores. Acceptance of returns includes taking possession of the item(s), packing the item(s) and shipping the return back to Amazon. Kohl's even plans to setup designated parking spaces.

Now that we understand the extent of the full partnership, is this a deal with the devil? Absolutely not.

As Amazon announces partnerships with key brands like Nike, buys retailers like Whole Foods and posts solid year over year sales growth each quarter, Amazon's momentum and allure only grows. With legacy retailers facing overinflated store bases, declining comp sales and online sales that are expensive to attain, it was only a matter of time before one tied up with Amazon. By partnering with Amazon, Kohl's gains that first mover advantage as the first brick & mortar retailer in the apparel space to partner with what is soon to be the largest apparel retailer. What does Kohl's really have to lose? Just think of the potential upside to these types of deals:

- Foot traffic to stores (despite returning Amazon product)

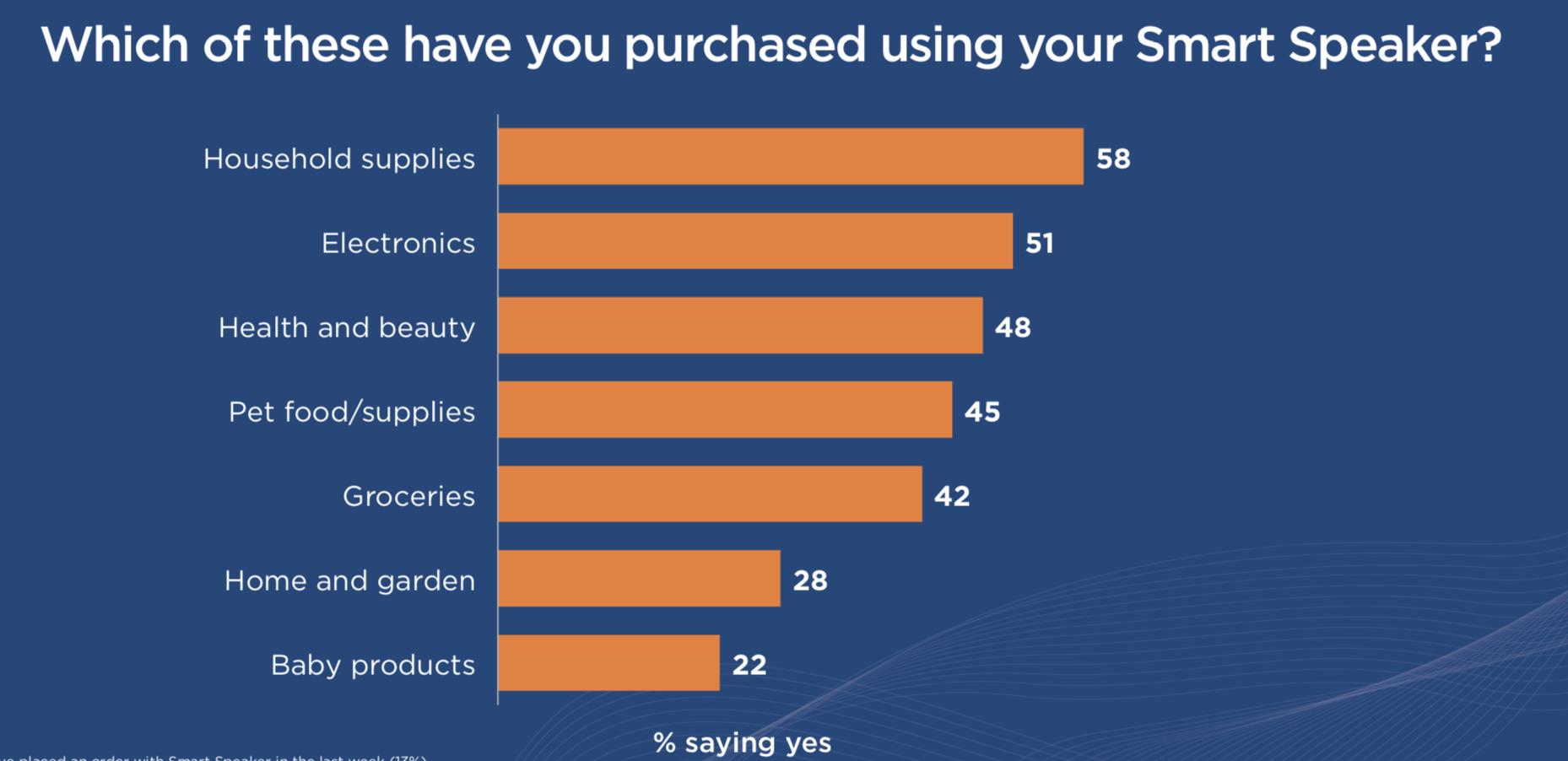

- On-trend electronics sales within voice space

- Inclusion within the Amazon flywheel

Don't be surprised to see a success story out of this partnership that includes rollout to additional stores or a branded web store on Amazon.com. Call it unconventional, call it crazy, but Kohl's is setting itself up for a partnership that will lead to many more opportunities than threats. Let's not forget that at one point Amazon ran Borders.com, Toysrus.com and Target.com.