Disclaimer: Long position held many times prior and actively holding now.

Robinhood announced another quarter of earnings this evening. Prior overviews are here, here, here, and here.

Assets Under Custody/Net Deposits - Assets saw an increase of 119%, an acceleration from 99% (vs 70% in the prior quarter) in the latest quarter versus last year. Keep in mind that a significant portion of the increase was due to TradePMR acquisition and the higher valuations of equity of cryptocurrency.

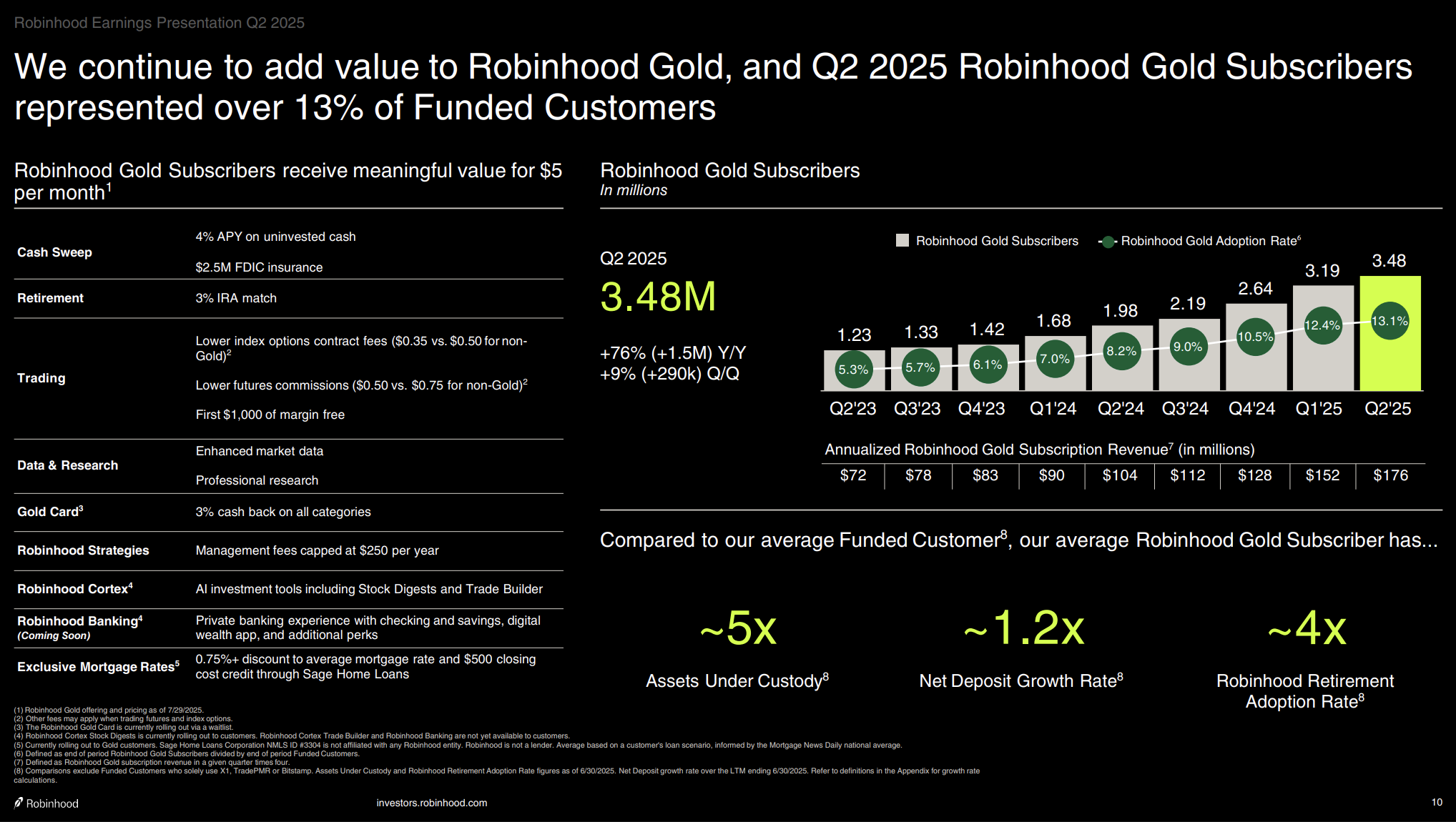

Gold Stickiness - The stickiness continues. Last 4 quarters adoption rate has grown from 10.5% to 12.4% to 13.1% to 14%. The subscriber base continues to grow and that stickiness leads to higher activity and lower churn. Last quarter the credit card count was over 300k but there was no reference this quarter yet the waitlist is over 3 million. Additionally, Assets Under Custody (AUC) was up 2.5x versus prior Q3.

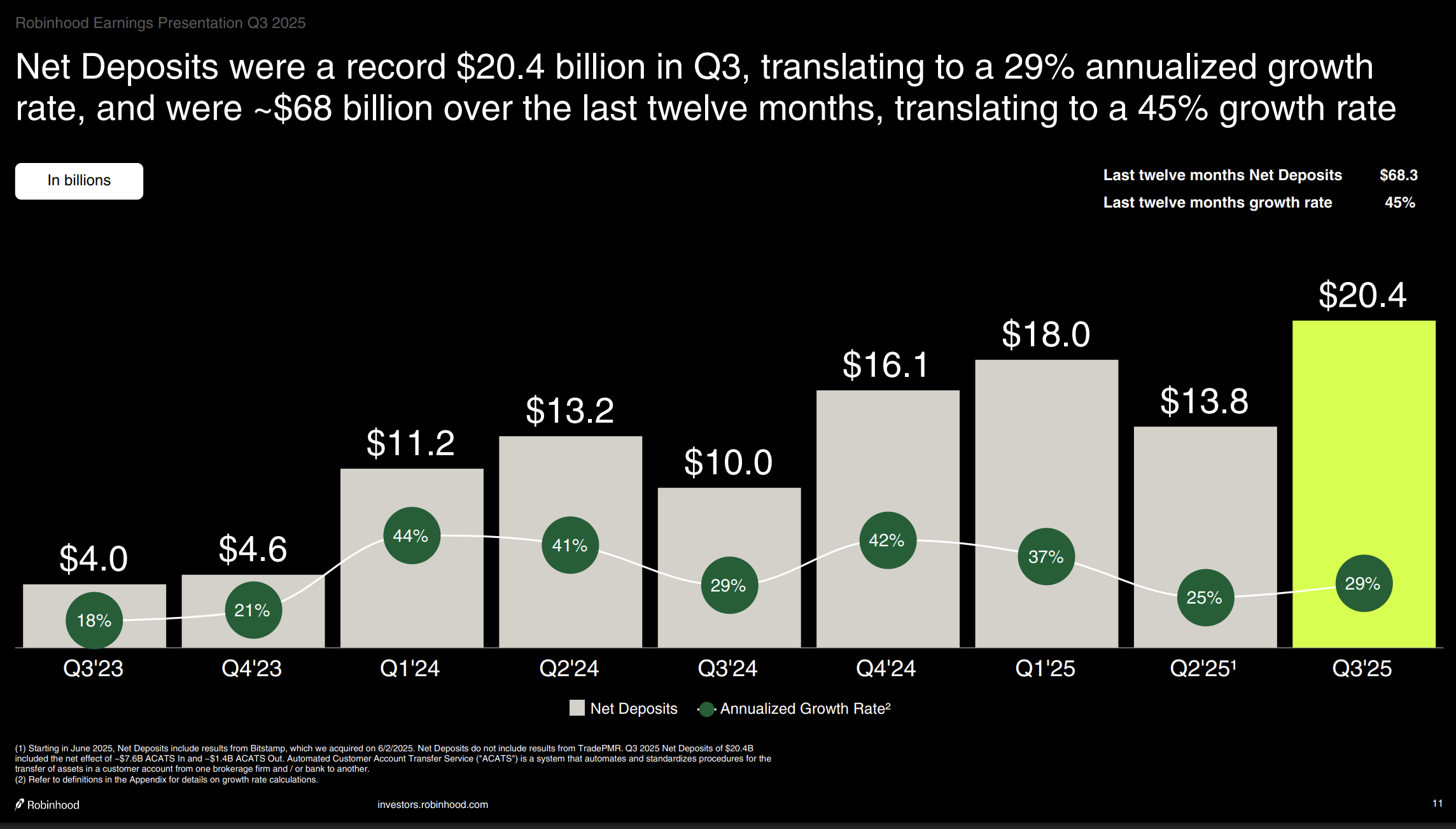

Net Deposits - Last quarter saw a deceleration but this quarter saw a return to growth with over 29% in annual growth from prior quarter of 25%.

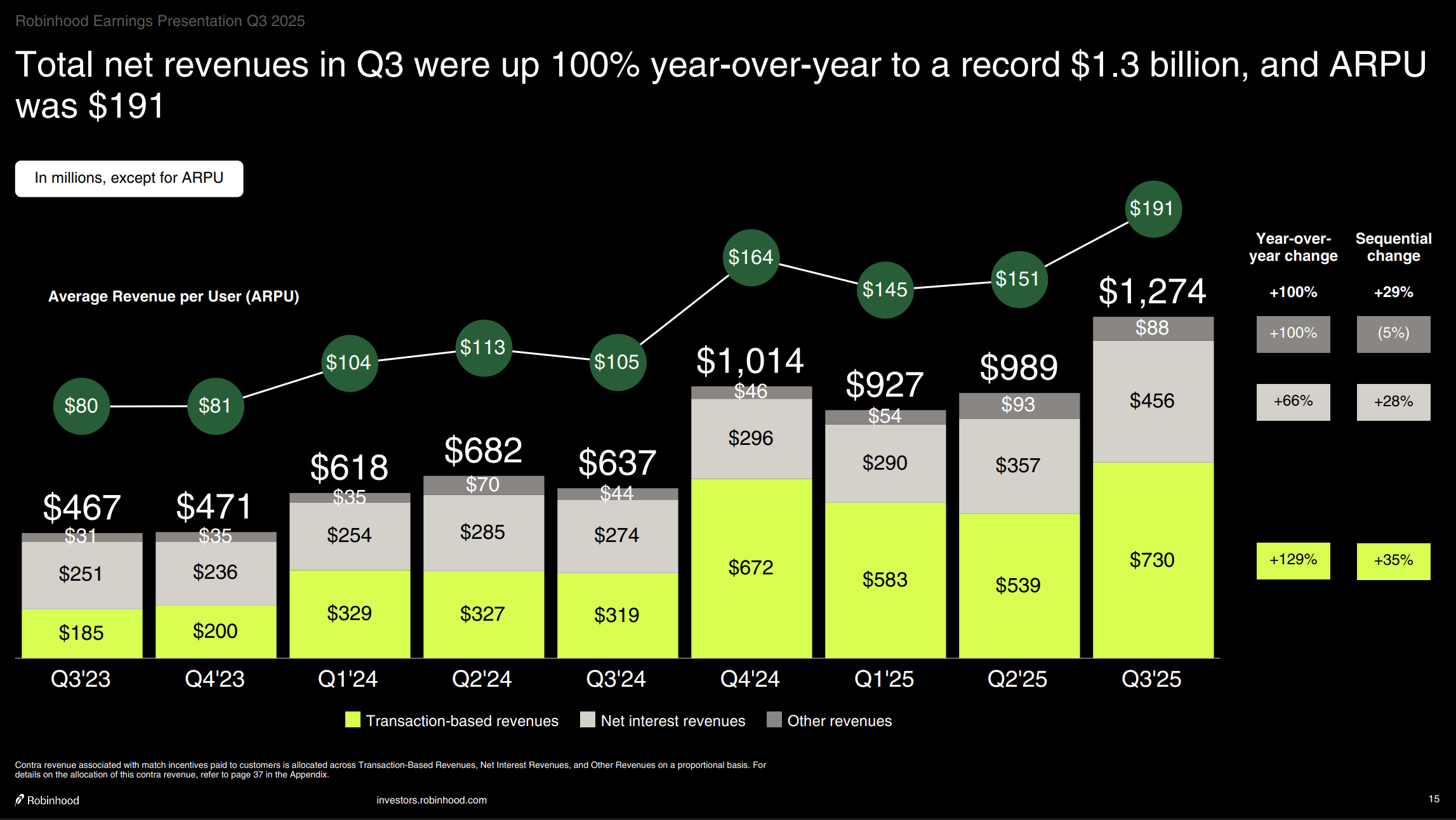

Average Revenue Per User (ARPU) Growth - Nearing $200 at $191 with strong year over year growth.

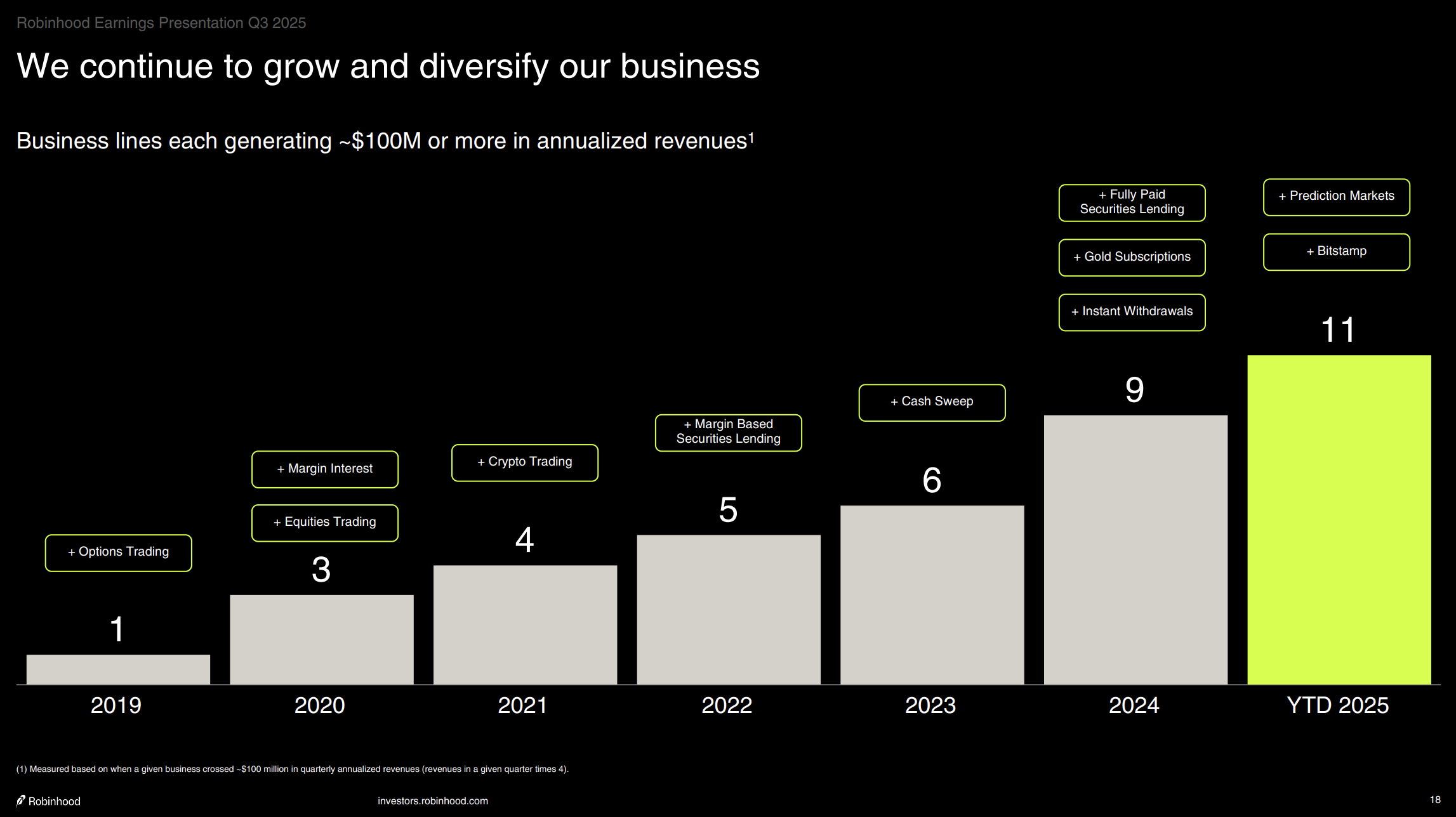

Bottom Line: The positive narrative remains intact and arguably accelerating. Gold subscribers continue to drive stickiness all as the revenue diversifies well outside of just crypto via credit cards, options, staking and eventual launch of banking. Robinhood continues to drive industry change and build complementary businesses within the core US market as well EU market. No reason not to remain long in my opinion despite the aggressive share price increases over the last several months years.